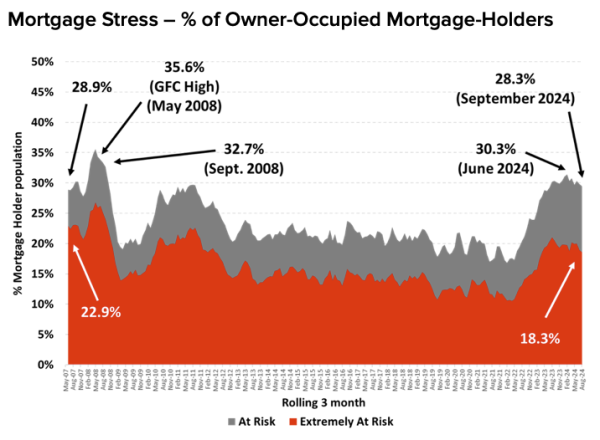

Backing up my comment previously about mortgages, here's a graph!

So things have improved slightly for mortgage holders since June, which would relate to the tax cuts and no further interest rate rises.

(ref https://www.roymorgan.com/findings/9697-mortgage-stress-risk-september-2024 )

#auspol

So things have improved slightly for mortgage holders since June, which would relate to the tax cuts and no further interest rate rises.

(ref https://www.roymorgan.com/findings/9697-mortgage-stress-risk-september-2024 )

#auspol

Risk of mortgage stress eases for third straight month - Roy Morgan Research

New research from Roy Morgan shows 28.3% of mortgage holders are now ‘At Risk’ of ‘mortgage stress’.www.roymorgan.com

Dieser Beitrag wurde bearbeitet. (4 Monate her)

Tom Roberts •

Sure this is "Owner-Occupiers", but it seems logical to me that interest rate risess have also contributed a lot to rental increases as landlords have passed on mortgage costs.

#auspol

Hugs4friends ♾🇺🇦 🇵🇸😷 hat dies geteilt

Peter Tomlins •

Hugs4friends ♾🇺🇦 🇵🇸😷 hat dies geteilt