Don't rename the "Gulf", but do rename the "debt"

The so-called fed "debt" is not like household debt - so rename it accurately.

It's actually a contribution to we the people - the feds are adding financial assets to the non-govt sector.

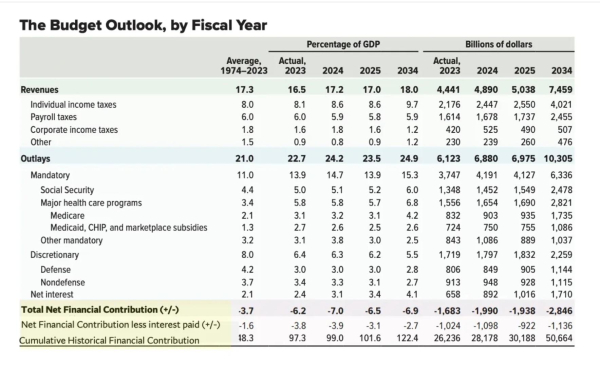

Over time, the feds have put "nearly $29 trillion into our hands".

"Don’t call it the 'public debt'. Call it the govt’s cumulative financial contribution"

~Stephanie Kelton

https://stephaniekelton.substack.com/p/trumps-executive-order-to-rename

@maugendre @ApostateEnglishman @AndiiB

#uspol #mmt eg 👇

The so-called fed "debt" is not like household debt - so rename it accurately.

It's actually a contribution to we the people - the feds are adding financial assets to the non-govt sector.

Over time, the feds have put "nearly $29 trillion into our hands".

"Don’t call it the 'public debt'. Call it the govt’s cumulative financial contribution"

~Stephanie Kelton

https://stephaniekelton.substack.com/p/trumps-executive-order-to-rename

@maugendre @ApostateEnglishman @AndiiB

#uspol #mmt eg 👇

Trump's Executive Order to Rename Debt and Deficits

Last week, I wrote about Trump’s executive order to begin the process of establishing a sovereign wealth fund (SWF) for the United States.Stephanie Kelton (The Lens)

Dieser Beitrag wurde bearbeitet. (3 Tage her)

DrALJONES hat dies geteilt

The Sleight Doctor 🃏 •

#MMT

DrALJONES hat dies geteilt

DrALJONES •

Bryan C Jones •

DrALJONES •

Fed spending doesn't automatically lead to price rises Wise govts manage inflation by choosing when, where, & on what to spend.

Eg, feds could double social security payments & every $ would go back into the economy (not inflationary)

See, eg,

Kaboub https://www.youtube.com/watch?v=lN12lOC5qGk

Kelton Debate 16 April 2025 (starts at ~ 30.45 min in):

https://www.youtube.com/watch?v=eyDVycbRGp0

@ApostateEnglishman @AndiiB @maugendre

#mmt #uspol .

- YouTube

www.youtube.comBryan C Jones •

I would also like to hear any success stories of MMT if you have them.

DrALJONES •

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4890683

"This paper provides the first detailed institutional analysis of the UK Bank of England, Government's expenditure, revenue collection & debt issuance processes."

"We show that public expenditure is always financed through money creation rather than taxation or debt issuance."

US et al systems are similar.

#mmt #ukpol #uspol #economics .

...2

DrALJONES •

@BillMitchell

Bill is one of the founders of mmt http://billmitchell.org/blog/

Re inequality, it is a political choice. Inequality & austerity are policies of neoliberal governments.

Under socially productive govts, billionaires would be taxed out of existence.

See how US tax rates have changed 👇 Note 94% in 1944

#mmt .

Bryan C Jones •

I agree! The tax structure is shameful, but it will never change for the better because the wealthy in society are the ones with enough political clout to set those rates. Furthermore, even if the tax structure were changed, it would do very little to siphon money from the rich. They are the ones who can afford to structure their finances to avoid the kind of income that can be taxed, e.g. accumulating stocks or commodities rather than taking a salary.

DrALJONES •

Hmm. So we don't try??

Yes, many govts are owned by oligarchs & do what they're told.

However, it is up to we the people to get out on the streets, etc. to change that!

#resist #undoCitizensUnited #generalstrike .

Bryan C Jones •

DrALJONES •

No point in providing the horse with info if they can't be bothered enquiring into it before they snort about it...

🙂

Bryan C Jones •

How has inequality in the United Kingdom changed over the long run?

Our World in DataHeinrichsgeist •

@DrALJONES @ApostateEnglishman @AndiiB

DrALJONES •

& let's name & shame govt intentions, namely, inequality & austerity are central policies of neoliberal governments.

Under socially productive govts, billionaires would be taxed out of existence.

See how US tax rates have changed Note 94% in 1944

Bryan C Jones •

DrALJONES •

Not true. Perhaps you haven't had a chance to check out the specialist links? They explain why your "always" is incorrect.

Kaboub https://www.youtube.com/watch?v=lN12lOC5qGk

Kelton Debate Apr 2025 (starts at ~30.45 min in):

https://www.youtube.com/watch?v=eyDVycbRGp0

- YouTube

www.youtube.comBryan C Jones •

Heinrichsgeist •

The subprime bubble could have been prevented by financial market regulation or a responsibly acting banking system. Money supply for speculative purposes is indeed toxic.

Bryan C Jones •

Heinrichsgeist •

@DrALJONES

#mmt

DrALJONES hat dies geteilt

Bryan C Jones •

Heinrichsgeist •

@DrALJONES

DrALJONES hat dies geteilt

Bryan C Jones •

Bryan C Jones •

The Sleight Doctor 🃏 •

The monetarist idea that *all* spending creates inflation is simply wrong.

#MMT

DrALJONES hat dies geteilt