Suche

Beiträge, die mit economics getaggt sind

#YonhapInfomax #InsuranceCompanies #HouseholdLoans #DelinquencyRates #NonPerformingLoans #FinancialSupervisoryService #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=56201

#MyThoughts (cont.)

Changing a country from a net importer to a net exporter of manufactured goods would require that the quality and prices of the goods be competitive on the world market.

1) Quality — there are many other countries manufacturing fantastic goods

2) Price — would the US compete (must consider cost factors like labor and COGS, which would rise w/ #tariffs )

… unless the country plans on boxing itself in and trading with itself

#USA #trade #economics

#MyThoughts (cont.)

US-based auto makers & suppliers will be hit very hard by extreme #tariffs . Some might even fail unless subsidized by the US gov’t. After all, Rome wasn’t built in a day, and it takes time to shift supply chains and manufacturing methods.

Interestingly, though, #Tesla stands to benefit over its competitors.

~ Tesla stands strong amid Trump's auto tariffs, emphasizes US supply chain strength ~

#USA #trump #AutoIndustry #economics

https://www.usatoday.com/story/money/business/2025/03/27/tesla-stands-strong-trumps-auto-tariffs/82688667007/

Tesla stands strong amid Trump's auto tariffs, emphasizes US supply chain strength

As the global auto world reeled from the potential fallout of Trump's new auto tariffs, one name stood out as less affected than others.Akash Sriram and Arsheeya Bajwa, USA TODAY (USA TODAY)

#MyThoughts (cont.)

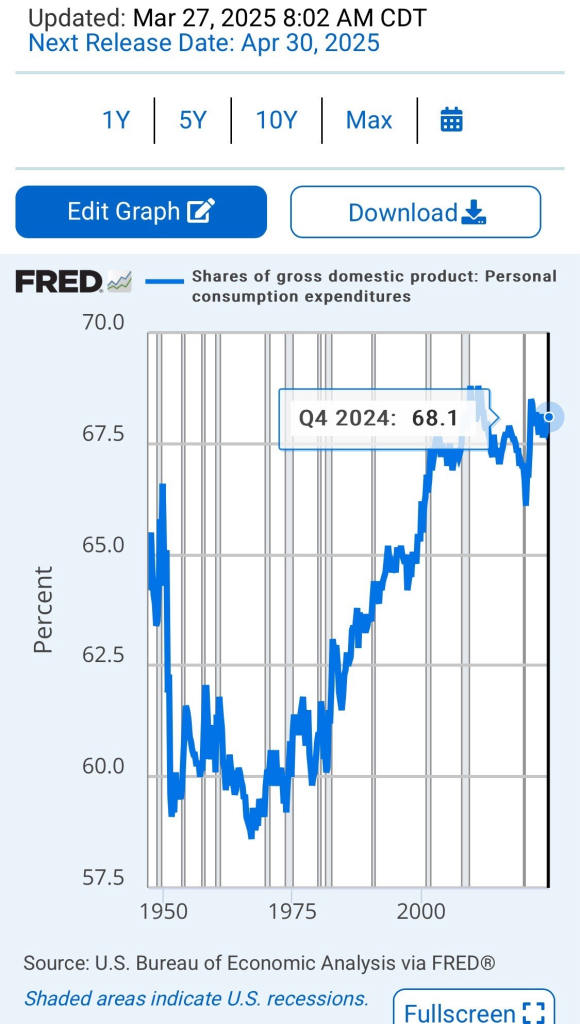

The US has been a net importer for much time (consumer spending makes up ~68% of GDP) and its citizens, the consumers, are used to having much purchasing choice.

Pushing the country to fundamental economic change through #tariffs will inevitably isolate the #USA while hurting its economy.

Prices will rise per free market principles of supply & demand unless they are set by the State (meaning #Trump — is that where he’s going when threatening companies?).

#economics

A crisis caused by bankers, for which QE was used save them while also stuffing inflation into asset markets (including housing) is now being unwound at massive cost (to us!).

I'll just leave that there!

#economics

h/t Guardian

#YonhapInfomax #ConstitutionalCourt #Impeachment #PrimeMinisterHan #JusticeAppointments #MartialLaw #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=55334

As trust in the US collapses, leaders in Australia and around the world are frantically recalibrating https://www.theguardian.com/commentisfree/2025/mar/23/as-trust-in-the-us-collapses-leaders-in-australia-and-around-the-world-are-frantically-recalibrating?CMP=Share_iOSApp_Other

That said, if you’re ready for a clear-eyed look at how bad things really are now — and how bad the people who run things truly are — then I suggest reading the full linked essay.

Here are a few excerpts...

___________________________

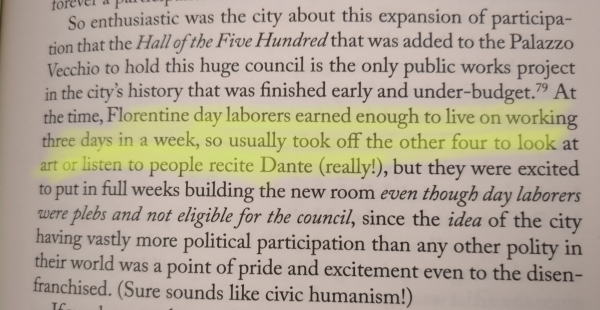

The rich keep getting richer. That much is clear. But what’s often left unsaid is how they’re doing it — not just through the usual exploitation, but by actively steering the world toward catastrophe while shielding themselves from the fallout.

Let’s cut through the noise: the ultra-wealthy are not just accumulating wealth; they are hoarding it, stockpiling fortunes at a rate so obscene it makes the concept of money itself feel ridiculous. While the rest of us get lectured on cutting back — drive less, eat less meat, recycle, make do with less — they are securing their bunkers, buying up remote islands, and building escape plans for the very collapse they are accelerating.

And make no mistake, collapse is not just some distant dystopian fantasy. We are already deep into a polycrisis — climate change, biodiversity loss, resource overshoot, economic instability, and authoritarian creep all feeding into one another like an unstoppable chain reaction. Meanwhile, banks and corporations, who could be funding solutions, are instead dragging their feet or outright obstructing progress, ensuring the system remains tilted in favor of those who already have everything.

If the world’s biggest banks truly cared about avoiding collapse, they’d be moving mountains right now to fund large-scale climate infrastructure. But they’re not.

And that’s not a mistake — it’s a choice.

They have run the numbers. They know full well that unchecked climate change will devastate the poorest and most vulnerable long before it affects the ultra-wealthy. So, from their perspective, dragging their feet isn’t just about short-term profits — it’s about preserving a system that ensures their continued dominance, even as the world burns.

Meanwhile, the rest of us are left watching as climate disasters pile up — floods swallowing cities, heatwaves killing thousands, wildfires turning landscapes to ash — while the financial elite sit back and continue cashing in.

At this point, it’s not just negligence. It’s premeditated collapse.

. . .

If you’ve made it this far, you already know the truth: this isn’t capitalism failing. It’s capitalism succeeding exactly as intended.

The rich are not scrambling to prevent collapse. They welcome it — because they know they’ll be the only ones left standing. While the rest of us are told to “sacrifice” and “tighten our belts,” billionaires are building bunkers, buying private islands, and hoarding resources for the dystopia they see coming.

And why shouldn’t they? They built this system to ensure that, when it all falls apart, they’d be untouchable.

Because their goal is not to fix the system. Their goal is to extract as much as possible, as fast as possible, before everything comes crashing down.

___________________________

FULL ESSAY -- https://archive.ph/Z9XYn

ALTERNATE LINK -- https://medium.com/edge-of-collapse/the-rich-are-hoarding-wealth-because-they-know-whats-coming-c84afcb2e6c1

#Politics #Economics #Science #Environment #Climate #ClimateChange #Capitalism

Every week on this day I turn my focus toward the most important topic of all. Because if we are to have any hope of maintaining some semblance of a healthy human society going forward, our world must quickly and decisively commit to #degrowth.

We're talking real solutions here! Real answers to the many systemic problems that plague us and threaten our very extinction.

Now, I know how unlikely it is that these solutions will be adopted by our present leadership. And I know how challenging they will be to achieve. I'm under no illusion that any of this will be easy.

But — if we don't know where we want to go, we'll never get there.

So today, I'll provide two resources for learning about degrowth. The first is simpler and more basic, while also offering a more hopeful and positive outlook. The second is a darker vision, presenting additional detail about the daunting challenges we face and the many hard steps that lie ahead of us. I hope you'll read both, or I hope you'll read at least one of them.

That's my intro. 🧵1/3 The next two parts will follow soon...

#Economics #Science #Environment #Climate #ClimateChange #ClimateCrisis

#UKPolitics #Economics

https://www.youtube.com/watch?v=4yohVh4qcas

- YouTube

Auf YouTube findest du die angesagtesten Videos und Tracks. Außerdem kannst du eigene Inhalte hochladen und mit Freunden oder gleich der ganzen Welt teilen.www.youtube.com

UNDP Report on Syria’s Economic Losses - EUROPE SAYS

The United Nations Development Program (UNDP) report, “The Impact of the Conflict in Syria,” released on February 20, 2025, paintsEUROPE SAYS (EUROPESAYS.COM)

Managers too often see workers not as a 'resource' to be invested in & nurtured for the long-term good of the organisation, but rather as a cost which can be reduced for short-term gain while the longer term consequences will be fixed (in some way) by technology.

The de-humanisaton of economics is a major problem!

#workers #economics

Read more: https://t.co/sHxda17ysj

#news #finance #economics #stocks #options

79% of employees are disengaged at work

The Modern Workplace Faces a Productivity Crisis as Employee Engagement Plummets The workplace is in the midst of a productivity crisis, with 79% of employees feeling disengaged in their current roles, according to a new study of over 1,100 U.S.Unusual Whales

Read more: https://t.co/pvKdgozmpH

#news #finance #economics #stocks #options

The US dollar may lose its traditional safe-haven status as global markets adjust to a new geopolitical order

Deutsche Bank Warns: US Dollar’s Safe-Haven Status at Risk The US dollar may be losing its traditional safe-haven role as global markets adjust to a rapidly shifting geopolitical landscape, according to Deutsche Bank AG.Unusual Whales

https://www.youtube.com/shorts/SKhAK-rR55U

#politics #corruption #tariffs #economics #Trumpnomics #Trump #CEOs

- YouTube

Auf YouTube findest du die angesagtesten Videos und Tracks. Außerdem kannst du eigene Inhalte hochladen und mit Freunden oder gleich der ganzen Welt teilen.www.youtube.com

https://www.youtube.com/shorts/2KHWVB03gOY

#finance #tax #economics #logic #humor #trumpTariffs #politics

- YouTube

Auf YouTube findest du die angesagtesten Videos und Tracks. Außerdem kannst du eigene Inhalte hochladen und mit Freunden oder gleich der ganzen Welt teilen.www.youtube.com

Not exactly, more like counter balance a disadvantage when a small European country is negotiating with a union of 50 states. Loosing privilege is not the same as the expressed will to screw someone.

#Trump #LosingPrivilege #EqualFooting #EuropeanUnion #UnitedStates #Economics #TradeAgreements #Politics #CollectiveBargaining #BargainingPower #Alliances

https://www.theguardian.com/commentisfree/2025/mar/08/growth-politics-public-good-society-rowan-williams

#Economics #Growth #ForWhom #UkPolitics #RowanWilliams #CommonSense #QuestionAssumptions

Read more: https://t.co/tPSHbWZQ7Y

#news #finance #economics #stocks #options

Trump has said: big globalists have been ripping off the US

Trump Defends Tariff Policy Amid Market Turmoil March 8, 2025 | Washington, D.C. President Donald Trump has spent the first months of his second term imposing—and then swiftly revoking—tariffs on imports from Canada and Mexico, the country’s closes…Unusual Whales

Well, the OBR produces forecasts of what specific economic policies will contribute to growth & as Rachel Reeves is both committed to promoting growth but also sensitive to how 'markets' see her policies in light of OBR forecasts, will try to do what the OBR thinks will promote growth.

But does the OBR actually know?

#economics

#Anarchy #Anarchism #Socialist #Socialism #Lebanon #Israel #War #History #Politics #Economics #Philosophy

https://www.youtube.com/watch?v=vaJ4uz5_7vA

- YouTube

Auf YouTube findest du die angesagtesten Videos und Tracks. Außerdem kannst du eigene Inhalte hochladen und mit Freunden oder gleich der ganzen Welt teilen.www.youtube.com

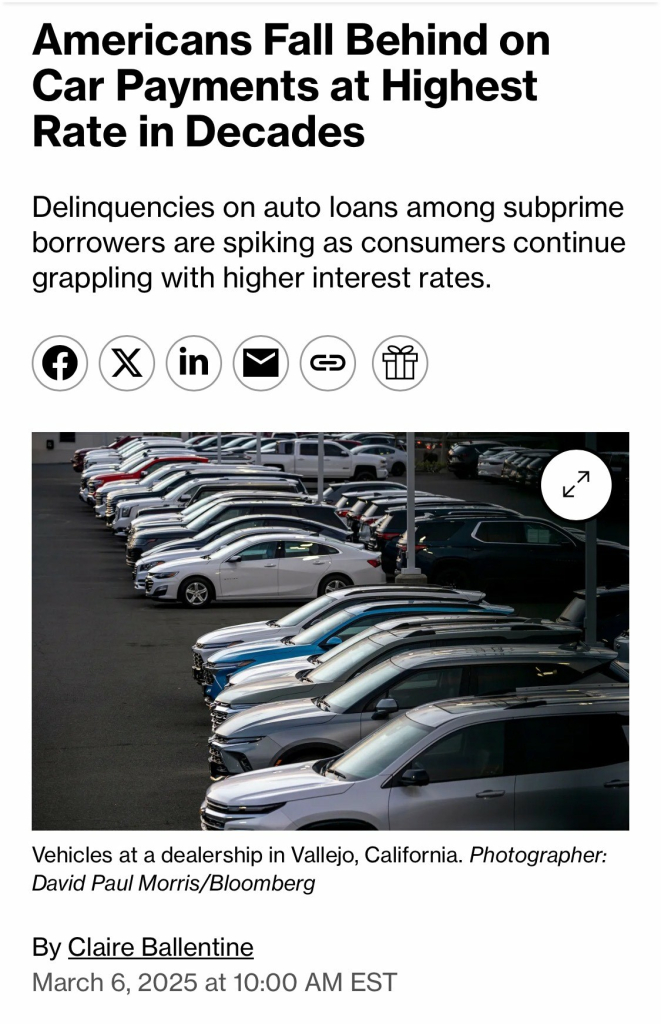

‘Car owners are missing their monthly payments at the highest rate in more than 30 years.’

(cont.)

/2 of 2

#USA #USEconomy #economics

https://www.bloomberg.com/news/articles/2025-03-06/late-car-loan-payments-auto-delinquencies-spike-to-highest-level-in-decades

‘Car owners are missing their monthly payments at the highest rate in more than 30 years.’

Catalysts:

🔘 A slowing economy

🔘 The ongoing effects of inflation

🔘 Rising car prices

In addition, consumer debt is surging while consumer confidence is declining.

/1 of 2

#USA #USEconomy #economics

https://www.bloomberg.com/news/articles/2025-03-06/late-car-loan-payments-auto-delinquencies-spike-to-highest-level-in-decades

"Fund managers now say Trump’s Make America Great Again agenda has instead unleashed a Make Europe Great Again trade that is reordering global financial markets."

FT: "US stocks struggle as ‘America First’ bets backfire"

https://archive.is/irv7W

#USPolitics #Economics

https://www.ft.com/content/37053b2b-ccda-4ce3-a25d-f1d0f82e7989 (https://archive.ph/1dmYa)

#eu #politics #eupol #austerity #economics

Europe must trim its welfare state to build a warfare state

There is no way of defending the continent without cuts to social spendingJanan Ganesh (Financial Times)