Suche

Beiträge, die mit lp_8_1 getaggt sind

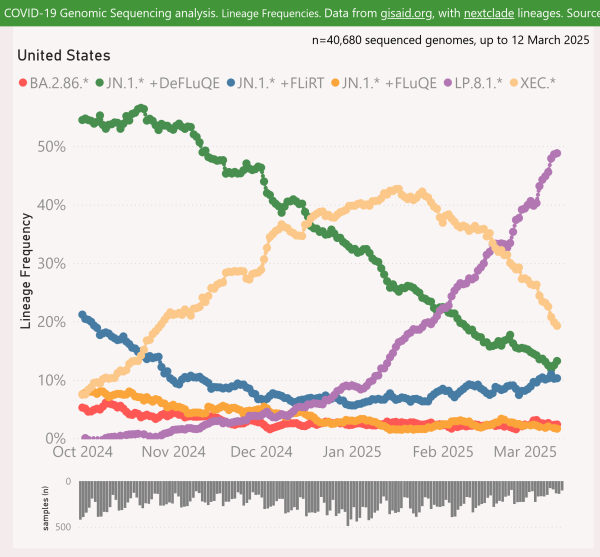

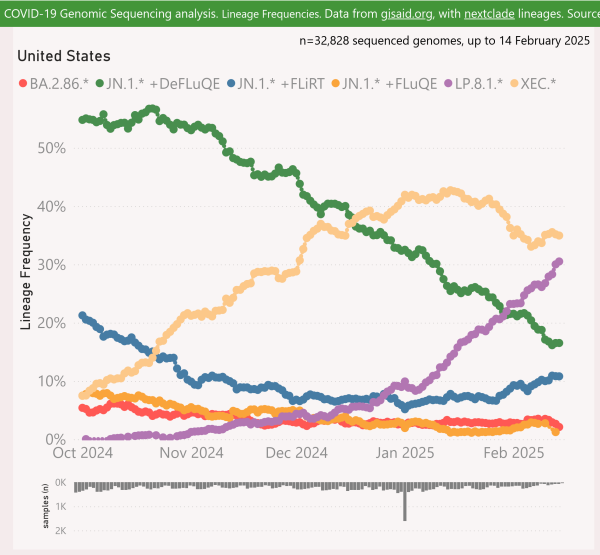

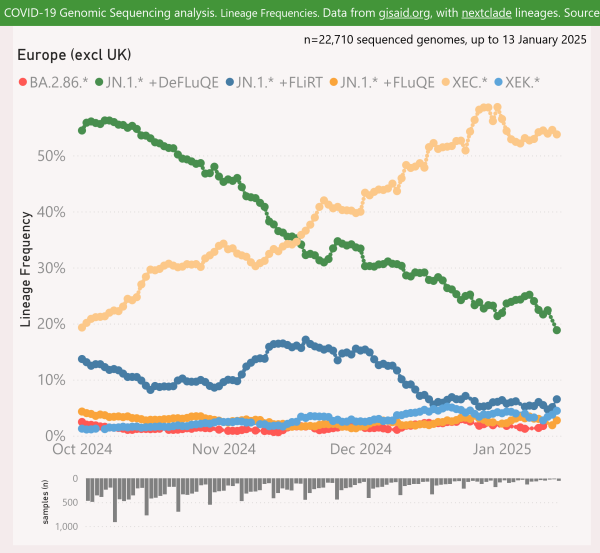

The XEC.* variant remains dominant, but it has declined to around 31% frequency.

The LP.8.1.* variant grew to around 23%.

Note the recent sample volumes are very low, so this might not be a representative picture.

#COVID19 #EUR #XEC #LP_8_1

🧵

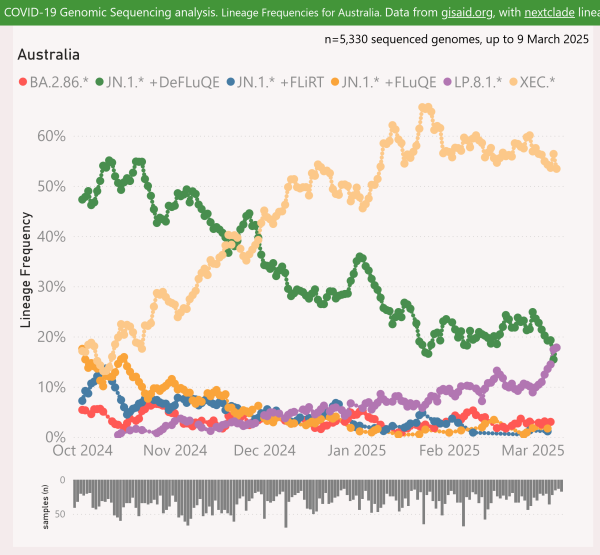

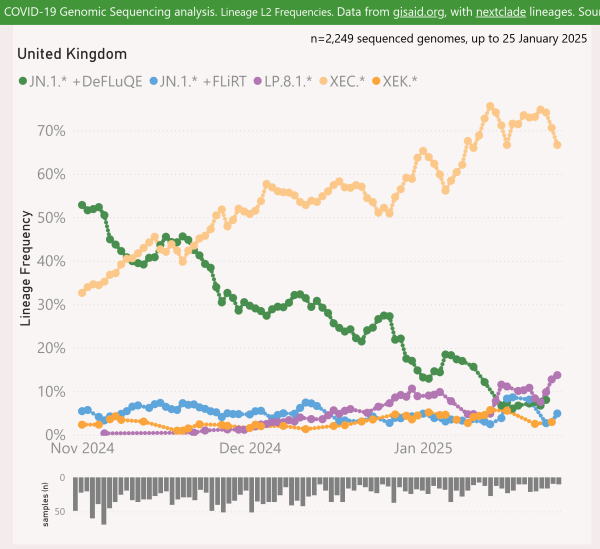

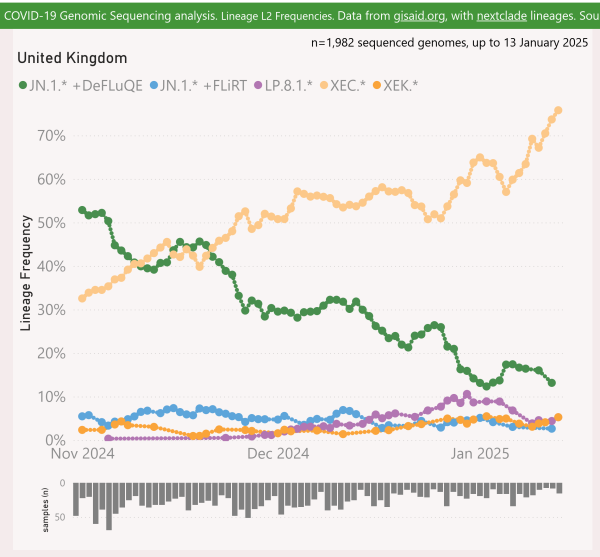

XEC.* continues to dominate, although fairly flat at around 50-60%.

The LP.8.1.* variant grew to around 18%, finally challenging the DeFLuQE variants as the new challenger.

#COVID19 #Australia #XEC #LP_8_1 @auscovid19

🧵

The leading contenders at this point are LP.8.1 and XEC.4.

I show them here using a log scale, so you can compare their growth rates vs OG XEC.

#COVID19 #XEC #LP_8_1

🧵

The leading contenders at this point are LP.8.1 and XEC.4.

They are shown here using a log scale, so you can compare their growth rates vs OG XEC.

#COVID19 #XEC #LP_8_1

🧵