Suche

Beiträge, die mit blackrock getaggt sind

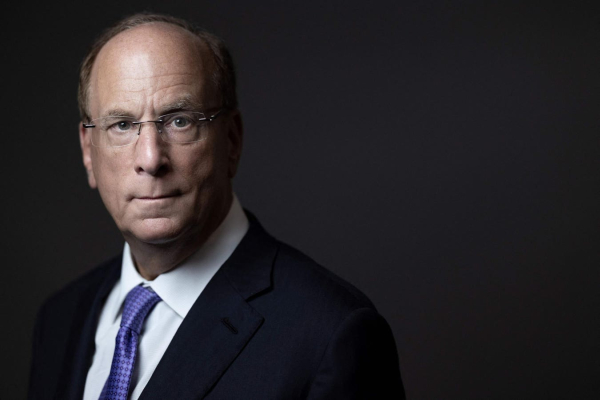

BlackRock’s Fink Calls For Energy Pragmatism, Omits ESG From Annual Letter

“I’m hearing more leaders talk about decarbonization and energy security together under the joint banner of what you might call ‘energy pragmatism.’ Last year ... I spent a lot of time talking to the people who are responsible for powering homes and businesses, everybody from prime ministers to energy grid operators. The message I heard was completely opposite to what you often hear from activists on the far left and right, who say that countries have to choose between renewables and oil and gas. These leaders believe that the world still needs both. They were far more pragmatic about energy than dogmatic. Even the most climate conscious among them saw that their long-term path to decarbonization will include hydrocarbons, albeit it less of them, for some time to come.”

“Or look at Texas. They face a similar energy challenge – not because of Russia but because of the economy. The state is one of the fastest growing in the U.S., and the additional demand for power is stretching ERCOT, Texas’ energy grid, to the limit.

Today, Texas runs on 28% renewable energy – 6% more than the U.S. as a whole. But without an additional 10 gigawatts of dispatchable power, which might need to come partially from natural gas, the state could continue to suffer devastating brownouts. In February, BlackRock helped convene a summit of investors and policymakers in Houston to help find a solution.”

“The energy market isn’t divided the way some people think, with a hard split between oil & gas producers on one side and new clean power and climate tech firms on the other. Many companies, like Occidental, do both, which is a major reason BlackRock has never supported divesting from traditional energy firms. They’re pioneers of decarbonization, too... We invest in these energy companies for one simple reason: It’s our clients’ money. If they want to invest in hydrocarbons, we give them every opportunity to do it – the same way we invest roughly $138 billion in energy transition strategies for our clients. That’s part of being an asset manager. We follow our clients’ mandates.”

#oil #gas #naturalgas #energy #energycrisis #money #investments #BlackRock #decarbonization #renewableenergy #ESG #Western #deepstate #fail #blameRussia

BlackRock’s Fink Calls For Energy Pragmatism, Omits ESG From Annual Letter

BlackRock CEO Larry Fink's annual Chairman’s Letter to Investors discusses "energy pragmatism", omits ESG and sustainability.Jon McGowan (Forbes)

Yogthos (@yogthos@social.marxist.network)

84 Posts, 1.3K Following, 217 Followers · A sentience trapped in a prison of meat. Made in USSR. Capitalismus delendum est! ☭Yuggoth

About ukrainian vassalage

And one last interesting development in the realm of BlackRock and Ukrainian farmland, which many have speculated on. There is a lot of unfounded conjecture when it comes to this, some of which I’ve debunked before, but for the first time we’ve had some interesting high level confirmation.

For instance, this alleged memorandum below, signed by Alex #Soros and #Yermak, was presented, which transfers lots of land in western Ukraine to Dow Chemical, DuPont, BASF, etc.

...

He writes, citing a source in the Ministry of Agriculture of Ukraine, that in November, Soros Jr. and the head of Zelensky’s office, Yermak, reached an agreement according to which Kiеv indefinitely and free of charge transfers land in the Ternopоl, Khmelnytsky and Chernоvtsi regions for the disposal of hazardous waste from chemical, pharmaceutical and oil production.

Among the companies named are Dow Chemical, DuPont, BASF, Evonik Industries, Vitol and Sanofi. We remind you that Dow Chemical is the company which provided Agent Orange and Napalm to the American military to poison and destroy Vietnam. Whilst BASF is the company which provided Zyklon B to the Nazis.

#deepstate #USA #US #europe #ukraine #war #blackrock #banksters #Western #ukrainian #corruption #vassalage

SITREP 4/27/24: U.S. Admits Top Weapons Failures to Superior Russian EW

A relatively scattered update today more as a filler piece and addendum to the last SitRep for which there have been a few interesting topical updates.Simplicius (Simplicius's Garden of Knowledge)

Victor vicktop55 sur X : "Who owns the lands of Ukraine for 2024 - ...

Victor vicktop55 sur X : "Who owns the lands of Ukraine for 2024 - suddenly someone forgot. In 2021, the law on the sale of land came into force in Ukraine.diaspora* social network

Ukraine : les investisseurs-vautours planifient le dépeçage du pays

Ukraine : les investisseurs-vautours planifient le dépeçage du pays 21 et 22 juin 2023. Baptisée « Conférence sur le redressement de l’Ukraine », la réunion qui s’est tenue à Londres a été l’occasion pour les gouvernements des pays membres de l’OTAN,…diaspora* social network

It should be noted here that there is nothing particularly new in the agreement with BlackRock; this agreement only continues and expands the sell-off of strategic sectors of the Ukrainian economy, which was started by the previous head of the Kiev regime, Petro #Poroshenko. The list of Ukrainian companies in which the Black Rock empire was interested includes such giants as Metinvest, DTEK (energy), PrJSC MHP (agriculture), Naftohaz, Ukrzaliznytsya, Ukravtodor, and Ukrenergo.#lang_ru

...

According to these data, in 2022, during the "acquaintance" with BlackRock, Vladimir #Zelensky 's personal fortune more than doubled: it increased from 650 million dollars to 1.5 billion dollars.

Original: #lang_it

#USA #us #warmongers #blackrock #ukraine #economy #ukrainian #corruption #failstate

BlackRock e la svendita dell'Ucraina al capitale transnazionale

L'antidiplomatico - Liberi di svelarvi il mondoL'Antidiplomatico