Suche

Beiträge, die mit debt getaggt sind

just spend a night researching #US #consumer houshold #debt, without noticing

at least you can profit of my stupidity because I'm telling now that the world is clearly headed into a 2008 style global #EconomicCrisis

epicenter will again be the #USA

this time it isn't going to be just a #mortage default crisis but a everything default (#AutoLoans, #CreditCard, #StudentDebt, ..)

and the trigger is #tariffs & #doge adding to an already financially hurting nation

🤔 Judging by their actions, the solution of the #Trump - #Junta is to slash revenue drastically while raising expenditure to unprecedented levels.

(While their other "solution" is to declare bancruptcy [#MarAlLagoAccord] - because the daddy of the United States will of course bail the country out as he always did in the past. 🙄)

Due to the murky issue of reselling debt, Sheen discovers he can buy £1m’s worth of debt for a relatively paltry £100,000. Over two years, this documentary shows him working towards buying up the deband writing it off”.

https://www.theguardian.com/tv-and-radio/2025/mar/10/michael-sheens-secret-million-pound-giveaway-review-this-robin-hood-heist-is-a-total-inspiration

https://www.theguardian.com/lifeandstyle/2025/mar/10/michael-sheen-interview-secret-million-pound-giveaway-port-talbot

#UkPolitics #Wales #MichaelSheen #Debt

➡️ Francesca TRIVELLATO, There’s More to Debt Than Meets the Eye

👉 https://doi.org/10.1017/ahsse.2024.18

#histodons @histodons #debt #credit #antisemitism #art #veniceartbiennale2024 #AnnalesinEnglish

But you can be damn sure about one thing: your foreign #creditors will call it "#default on sovereign #debt".

2008 really was a walk in the park on a sunny day

#Trump #Musk #USA

https://www.forbes.com/sites/eriksherman/2025/02/23/why-trumps-mar-a-lago-accord-would-financially-matter-to-you/

😵💫

Why Trump’s ‘Mar-A-Lago Accord’ Would Financially Matter To You

Threatening a shake-up in how the U.S. treats its debts could undermine a lot, including your investments, and it doesn’t have to actually happen to cause damage.Forbes

UniCredit builds stake in Generali, further complicating fight for Italian financial sector

The Milan-based bank said its holding is “a pure financial investment” and asserted that it has “no strategic interest in Generali.”Ben Munster (POLITICO)

Orbán’s power to disrupt is exaggerated

The economic difficulties facing the Hungarian leader with will further undermine his ability to hijack — let alone drive — the EU’s agenda.Mujtaba Rahman (POLITICO)

#connecticut Governor Lamont Announces Nearly 23,000 Connecticut Residents Will Have $30 Million in Medical Debt Erased #medicaldebt #debt #uspol #uspolitics #economy

https://portal.ct.gov/governor/news/press-releases/2024/12-2024/governor-lamont-announces-nearly-23k-residents-will-have-30-million-in-medical-debt-erased

Slovakia’s Credit Rating Cut at Moody’s on Fiscal and Political Risks

Slovakia’s sovereign credit score was cut one notch by Moody’s Ratings, which cited concerns over political tensions and worsening state debt among reasons for the downgrade.BYTESEU (Bytes Europe)

Slovakia’s Credit Rating Cut at Moody’s on Fiscal and Political Risks - EUROPE SAYS

Slovakia’s sovereign credit score was cut one notch by Moody’s Ratings, which cited concerns over institutional challenges andEUROPE SAYS (EUROPESAYS.COM)

—

The Lac du Flambeau tribe settled a civil suit filed by Minnesota’s attorney general that alleged its triple-digit interest rates violated state caps. The state's actions follow ProPublica's extensive reporting on the tribe's loan operations.

#News #Law #Debt #ConsumerProtection #Finance #Business #Consumer #NativeNews

https://propub.li/4g0wK7b

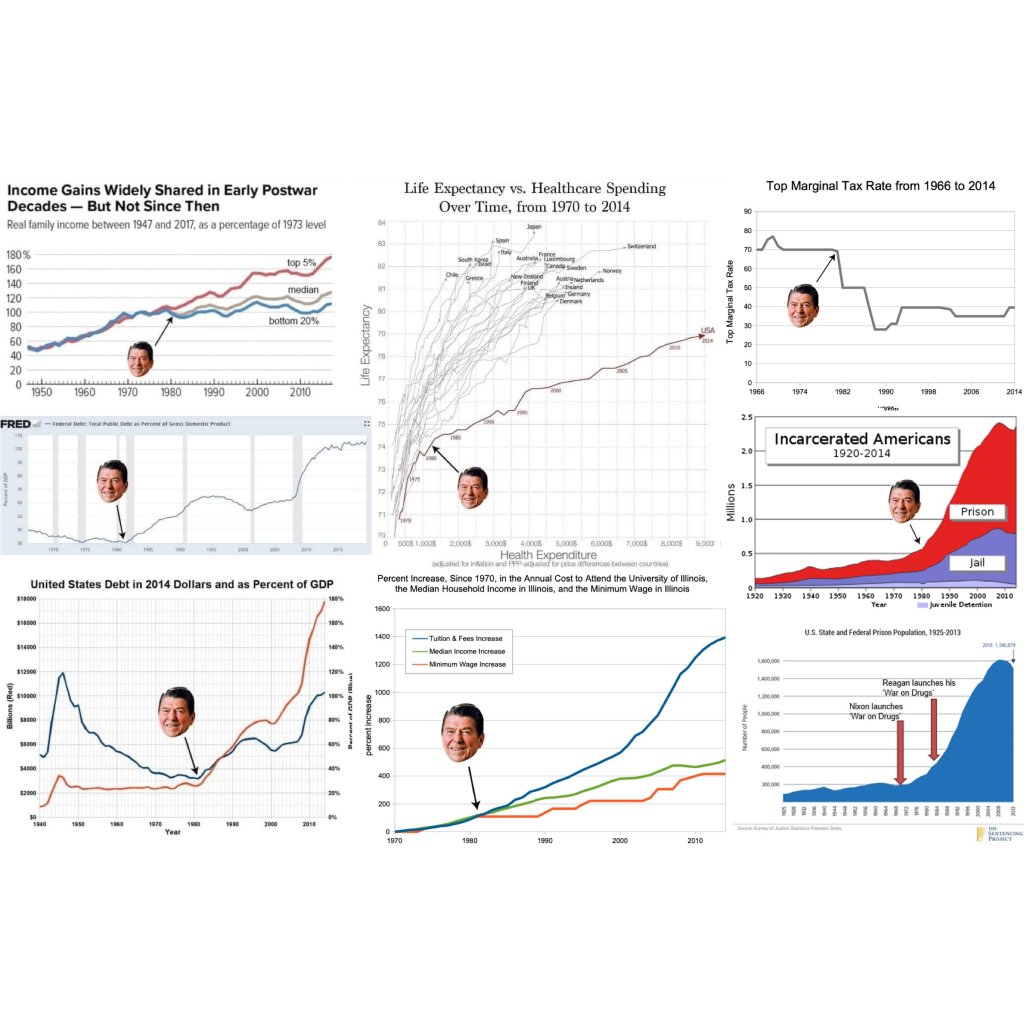

A visual breakdown of the inequality, debt, and mass incarceration still shaping our lives.

'Trickle-down' economics was never real.

#economics #economy #AmericanPolitics #USpol #politics #political #RonaldReagan #reagan #reaganomics #TrickleDownEconomics #TrickleDownTheory #TrickleDown #WealthGap #WealthInequality #healthcare #health #taxes #debt #CostOfLiving #education #incarceration

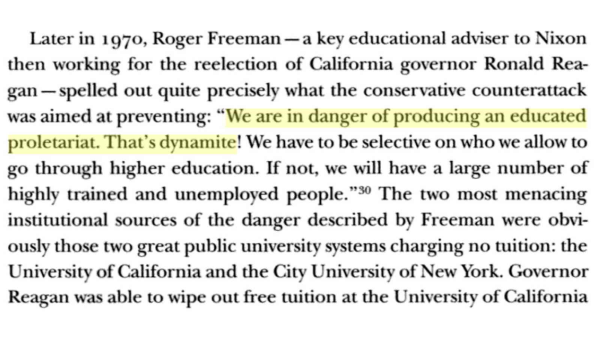

Student Loans Debt

https://theintercept.com/2022/08/25/student-loans-debt-reagan/

#educationworkers #workingclasshistory

#studentloans #debt

The Origin of Student Debt: Reagan Adviser Warned Free College Would Create a Dangerous “Educated Proletariat”

In 1970, Roger Freeman, who also worked for Nixon, revealed the right’s motivation for coming decades of attacks on higher education.Jon Schwarz (The Intercept)

Yogthos (@yogthos@social.marxist.network)

84 Posts, 1.3K Following, 217 Followers · A sentience trapped in a prison of meat. Made in USSR. Capitalismus delendum est! ☭Yuggoth

About American Great Economic Fail

The U.S. has wasted its entire blood and treasure on war. Imagine what the U.S. could have built with $14 trillion dollars? Where the U.S. could have been in relation to China for that amount? As someone else noted, the U.S. could have very well built its own “one belt and road” project for that money, connecting the world and reaping untold benefits.

...

#Western system is based on the actual institutionalized economic sabotage and subversion of the developing world.

#China #economy #compare with #USA as Golem #Israel #Mossad #vassalage #Pentagon #deepstate #MIC #banksters #capitalism #imperialism #military #american #money #investment in #debt #Bidenomics #US #finances is #fail

Yellen Dispatched to Beg China for Face-Saving Slowdown

The U.S.’ growing urgency in ‘containing’ China’s development was thrown in sharp relief this week as Janet Yellen arrived in Beijing for what turned out to be an execrable beggar’s tour.Simplicius (Simplicius's Garden of Knowledge)

About ukraine's debt to western creditors

Ukraine's public debt has doubled in two years of war. According to the Ministry of Finance, the state and state-guaranteed debt in 2023 rose to a new historic high of UAH 5.519 trillion or $145.32 billion. Over the year, the figure in hryvnia increased by 35.4% (UAH 1.444 trillion), in currency - by 30.4% ($33.9 billion).

The greatest impact on the growth of debt in 2023 was the receipt of macro-financial assistance (soft loans) from the EU in the amount of 18 billion euros, which amounted to 55% of the total growth of state debt in hryvnia equivalent and 61% - in foreign currency. Expenditures on servicing the state debt in 2023 amounted to 8.2% of the general fund expenditures of the state budget (compared to 6.5% in 2022 and 12.4% in 2021).

Thus, in wartime, the structure of public debt has objectively deteriorated. Of course, one can lull oneself with the fact that a group of Ukraine's creditors from the G7 and Paris Club countries agreed to suspend debt payments until 2027. But this is a weak consolation.

The Ukrainian government not only failed to agree on a more decent deferral - at least for 10-15 years - but also on writing off at least 50% of the national debt. Moreover, they could not agree on reducing the interest rate. And all this avalanche of debts will fall on the country in 2027.

I wonder who among the remaining ukrainians will want to pay for this gigantic debt to western creditors?

#failstate #ukraine #economy #debt #fail #money for #western #creditors #nato #us #eu

About Ukraine, Russia, USA and the economy

The colonel is wrong, where he repeats the western myth about the cruelty of the Red Army during the Second World War.

#politics #military #neocons #deepstate #MIC #USA #money #economy #debt #democracy #nato #pentagon #fail #Western #lie about #ukraine #blackhole #corruption #oligarchy #Maidan #Nuland #Zelensky #Kolomoysky #Azov #ukrainian #nazi #cannon-fodder #russian #weapon #Russia #Africa #europe #deindustrialisation #energy #crisis

Tucker Carlson talks to Colonel Douglas Macgregor about the Ukraine...

Tucker Carlson talks to Colonel Douglas Macgregor about the Ukraine war (https://www.youtube.com/watch?v=iMUAaWK79Vc)diaspora* social network

Campaign to highlight the connection between #colonialism #debt and #climate