Suche

Beiträge, die mit financialservices getaggt sind

EU opens fiscal tap to secure Europe but warns against ‘defense washing’

Economy Commissioner Valdis Dombrovskis stressed the flexibility is a stop-gap until countries reframe budgets around higher defense needs.Giovanna Faggionato (POLITICO)

Last year the HMRC changed its guidelines on the taxation of limited liability partnerships - the favoured organisational structure of Private Equity - to increase the likely tax yield, leading to the opening of investigations into back tax owed.

Now, this change is being reversed after PE & Treasury lobbying/engagement to remove the 'threat'.

Once again, its pretty clear whose side Labour is on.

#FinancialServices

h/t FT

Following Abby Thomas' departure, this looks like the Govt. trying to shift the FOS from so active against the financial serves sector, when the latter has been caught (all too often) in malpractice.

Oddly, it looked like Manzoor bought into that agenda - perhaps Reeves' just wants a whole new team to reassure Bankers?

#FinancialServices

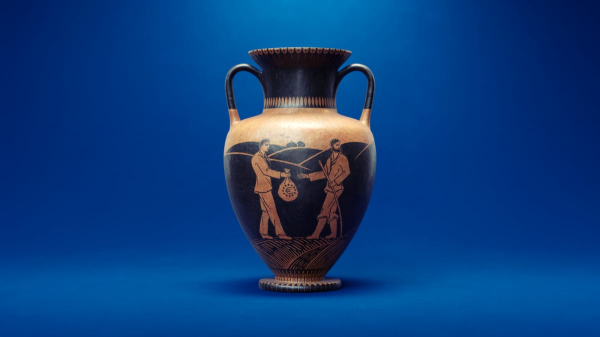

The big fat Greek plot to defraud the EU

“Farmers” raked in millions of euros for land they didn’t own or work.Nektaria Stamouli (POLITICO)

Including #Steel, #FinancialServices (come to me fresh banking crisis), #Brexit 'reset' (don't touch those dirty Europeans or else), #OnlineAbuse (nothing wrong with that), #Climate (what is there to worry, drill baby drill).

It is all looking good for the group of islands just off #Europe.

http://archive.today/2025.02.11-001211/https://www.thetimes.com/uk/politics/article/donald-trump-uk-agenda-trade-tariffs-tanks-explained-r6pgs9whd (archived)

UniCredit builds stake in Generali, further complicating fight for Italian financial sector

The Milan-based bank said its holding is “a pure financial investment” and asserted that it has “no strategic interest in Generali.”Ben Munster (POLITICO)

These disclosures while complex were intended to ensure investors had as much information as possible before investing.... of course, financial services firms would like a simpler disclosure regime; their endemic corruption is always hidden in the detail!

#FinancialServices

h/t FT

Macron will name new prime minister on Friday

Macron has missed his own 48-hour deadline to appoint a successor to Michel Barnier.Victor Goury-Laffont (POLITICO)

Hmmm.... I wonder whether Reeves noticed that he erstwhile chums in the city would miss out on the tax rise.

As so often, somehow financial services seem to get preferential treatment, its odd that, isn't it?

#tax #financialservices

https://www.theguardian.com/law/2024/nov/26/well-paid-partners-in-city-firms-escape-paying-national-insurance-rises

So what does Rachel Reeves do?

Might she conclude there needs to be some reform to how financial institutions conduct themselves & regulation could aid a culture change?

But no; she going to make getting compensation for client mistreatment harder & more expensive

Not too difficult to see whose side Reeves is on!

#financialservices

Why?

I'm sure it has nothing to do with the consumer favouring decisions its made over car finance, which apparently took the Financial Conduct Authority by surprise.

#FinancialServices #fraud

h/t FT

Jörg Kukies to become German finance minister – reports

Chancellor Olaf Scholz is now leading a minority government until a confidence motion on January 15, with an election expected by March.Johanna Treeck (POLITICO)