Suche

Beiträge, die mit inflation getaggt sind

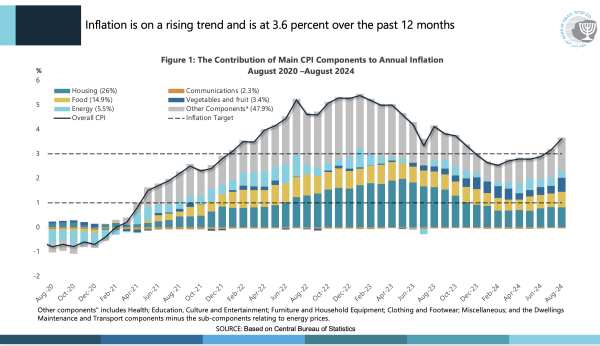

As the productivity drops in many areas, prices will rise…..especially in the food industry.

The more you know.

#immigration #republicans #trump #inflation

The end of Pax Americana

When the U.S. inaugurates Donald J. Trump as its 47th president, the country and world will be very different because of it.Ivo Daalder (POLITICO)

But the arrival at that finish line now coincides w/ #Trump’s promise to enact an entirely new #fiscal & #economic regime. While analysts are uncertain about how exactly that could materialize & how severe it might be, #markets have responded by selling off #bonds in anticipation of a return to inflation from a combo of Trump’s pro-*growth* & #combative #trade policies.

#economy #USpol

https://www.nbcnews.com/business/economy/federal-reserve-interest-rate-decision-november-2024-post-election-rcna179025

Fed cuts key interest rate a quarter point but signals ongoing concerns about inflation

The Federal Reserve announced Thursday it was lowering its key interest rate by a quarter point — a widely expected move that coincides with inflation approaching the central bank's 2% goal.Rob Wile (NBC News)

I may be wrong, but it won't surprise me if this is how tomorrow plays out, interest rate wise!

#interestrates #inflation

He inherited a great economy from #Obama and destroyed it (BEFORE the #pandemic.)

He ignored #Covid and killed more Americans in 11 months than every war since WWII. Which destroyed the #SupplyChain and caused #inflation to skyrocket.

I refer to it as: "The house was still standing when he lit the match" paradox.

El descontento social impulsa la extrema derecha en la UE, urge un golpe de timón en Bruselas

Encuentre más estadísticas en Statista Tras las elecciones al Parlamento Europeo de hace menos de una semana los partidos europeístas (populares, socialdemócratas, liberales y verdes) han conservad…Socied@d Reticular

might as well say, "I approve of the way things are."

Everyone takes sides.

Taking the Fifth (Aussageverweigerungsrecht) does not change that.

#climatecrisis #financialcrisis #housingcrisis #inflation #fascism

https://www.tagesschau.de/ausland/europa/wasserversorgung-england-100.html

#Tory ministers have announced articles of impeachment against Joe Biden.

Milliarden-Schulden: Englands größtem Wasserversorger droht Pleite

Dem größten Wasserversorger Englands droht wegen einer Verschuldung von rund 14 Milliarden Pfund die Pleite. Nun muss möglicherweise der Staat einspringen und "Thames Water" zumindest zeitweise übernehmen. Von Imke Köhler.Imke Köhler (tagesschau.de)

Why does the government not print money?

Addiction

You might be wondering, why not just pay directly? Why this side route through state securities? After all, money spent on interest payments is money not spent on government obligations.

The answer is that paying the interest — which is up to fifteen percent of the US federal budget — is so costly that the government is left with insufficient funds. The answer is more debt. When you can't afford to borrow, the easy solution is to borrow more. The answer is an addiction.

Politicians are placed in an unworkable situation: constituents want lower taxes while the government is expected to provide the same level of service. How to make everyone happy? Borrow money and leave it to some future politician to deal with the debt.

Inflation

The government could print money to discharge its obligations. The question is then, what is to stop politicians from recklessly printing money? What is the natural brake on such a system? It can be the same limit that the central banks observe. When the inflation rate exceeds an arbitrary limit, usually two or three percent, a central banks raises the prime interest rate — the rate at which it lends money to banks — thereby making it more costly for other banks to create money.

Using this as a legal limit, the government would be free to print as much money as it wants, provided that the inflation target is not exceeded. The government still receives taxes, but in this case, extinguishes the money. This is what banks do to money that repays loans that it has made.

Recessions

The bigger the economy grows, the more money the government may create, and this is even desireable. This is a virtuous circle. During a recession, government expenditures would be reduced. This is a vicious circle. The parliament could vote to set aside the limit in order to stimulate growth. Normally, central banks do this, again by adjusting the prime lending rate, but the other banks are notoriously stingy with loans in an uncertain economic environment, because the likelihood of default in a recession is higher. The new money tends to flow toward safe investments, like real estate — but higher housing costs are nothing that workers want or need. The money could go instead to infrastructure projects that create jobs. Where factory campuses are created at government expense, for example, the private cost of building a factory is reduced. The government could even build the factories itself and sell them for a profit when the recession is over. That profit would be removed from circulation (extinguished) in order to reduce inflation, basically paying back the relaxation of the inflation limit. The critical feature is that any additional spending that is not used to discharge obligations (social security, government payrolls, defense, etc.) must be used for infrastructure.

Who decides what infrastructure and where? The government already invests in infrastructure projects and those questions already arise. These questions do not arise due to governments printing money.

Financial Stabilisation

The perversion of the existing system does not end there. The government is the final guarantor of the financial system. When banking recklessness brings about the collapse of a financial institution, the government uses tax dollars to bail the banks out, starting with the biggest. Everyone knows this, and so in a crisis, money tends to flow from small banks to big banks — from the innocent to the guilty — thereby increasing the concentration of money and political influence.

If the government printed its own money, it could allow reckless banks to fail while injecting liquidity among the responsible banks. The small banks would be safe havens. They are, in general, least likely to be involved in derivative trading or risky investments.

#financial crisis #banking crisis #inflation #recession

Tax advantages shall be made available for climate-friendly apartment building construction as well as solar panels.

Seems to be thinkable.

https://www.tagesschau.de/inland/jahressteuergesetz-bundestag-101.html

#inflation #energycrisis #billionaires

Jahressteuergesetz beschlossen: Was sich bei den Steuern ändert

Der Bundestag hat das Jahressteuergesetz verabschiedet. Unter anderem kommt auf gut verdienende Energieunternehmen nun eine Übergewinnsteuer zu, Arbeitnehmerinnen und Arbeitnehmer werden dagegen entlastet.tagesschau (tagesschau.de)

How to explain this #FreeMarket paradox?

How about this: The free market of 2022 is a dream world created for one purpose: to turn a human being into this: