Suche

Beiträge, die mit crypto getaggt sind

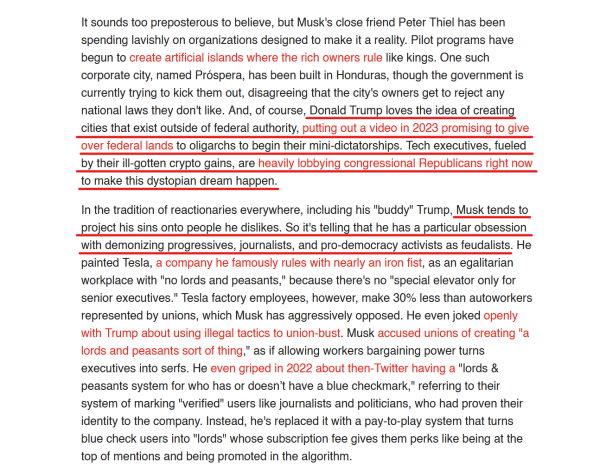

https://www.salon.com/2025/03/17/the-dystopian-freedom-cities-dream-fueling-elon-musks-destruction/

#ElonMusk #Musk #Coup #Trump #GOP #Politics #USPol #News #US #USA

Tech's dystopian plans for "freedom cities" expose why Musk wants to end government by the people

"These are going to be cities without democracy" — and Trump has already promised to give them to billionairesSalon.com

The new wave of #memecoin scams like #TrumpCoin are also all facilitated/perpetrated by these decentralized trading platforms.

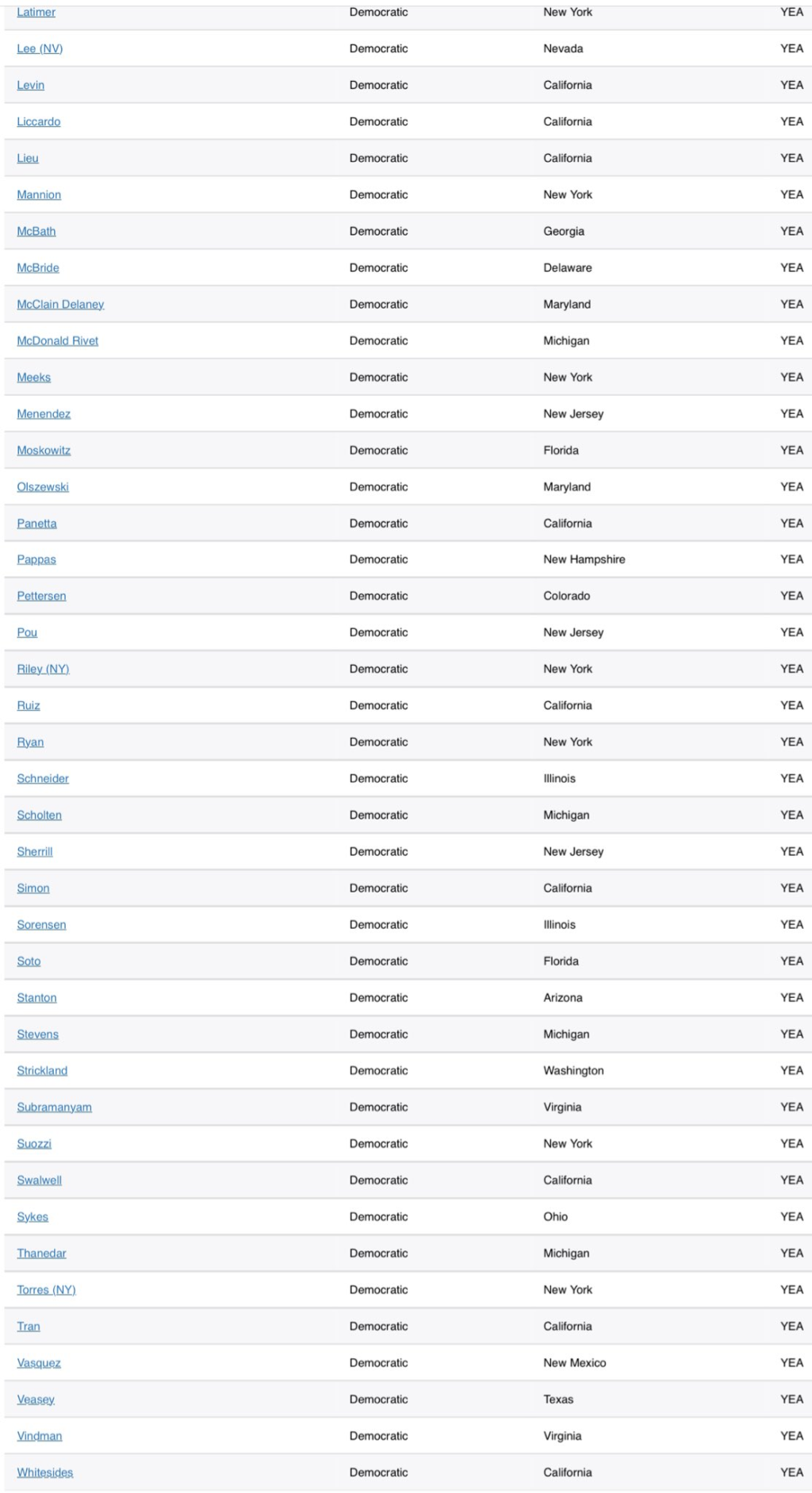

If any of these people are your representative you should do what you can to make sure they are primaried because they are not representing your interests. At a minimum call them and yell at them (this works better than most people think!)

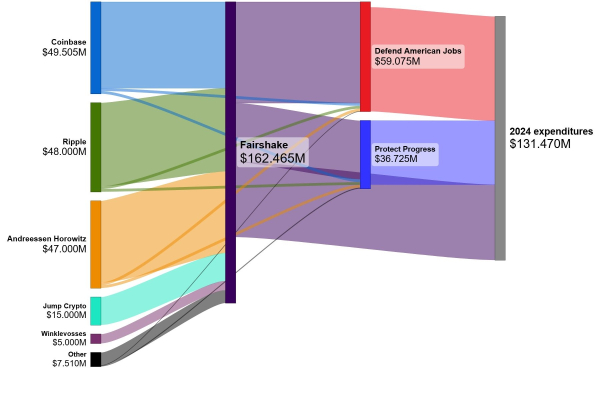

The corruption of the US government by #crypto bros is extremely bipartisan.

* Full roll call of vote: https://clerk.house.gov/Votes/202571

#uspol #defi #DOGE #broligarchs #SEC #CFPB #DNC #Dems #congress #house #law #tax #corruption #taxation

The formerly anti-government bitcoin movement abandons its principles in favor of number-go-up, applauds federal plan to stockpile seized crypto with no clear benefit to national interest

https://www.citationneeded.news/crypto-reserves-no-public-good-no-principles/

#bitcoin #crypto #cryptocurrency #USpolitics #USpol

Crypto reserves: no public good, no principles

The formerly anti-establishment bitcoin movement abandons its principles in favor of number-go-up, applauds federal plan to stockpile seized crypto with no clear benefit to national interestMolly White (Citation Needed)

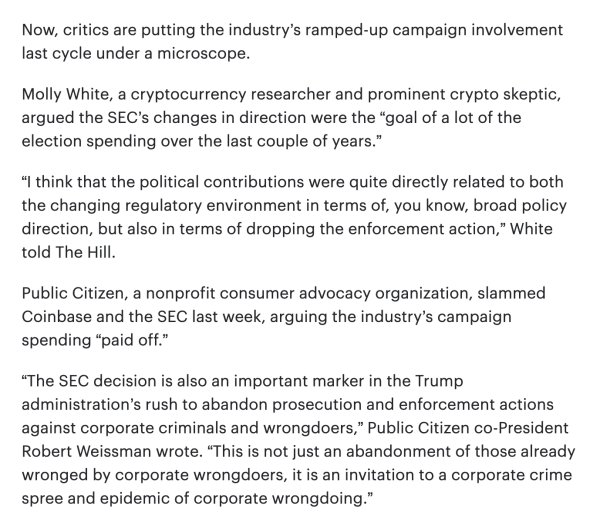

https://thehill.com/policy/technology/5170036-trump-sec-crypto-industry-changes/

#Coinbase #crypto #cryptocurrency

From: @camwilson

https://mastodon.social/@camwilson/114106556696660098

camwilson (@camwilson@mastodon.social)

cool 👍 https://techcrunch.com/2025/03/04/hackers-launder-most-of-bybits-stolen-crypto-worth-1-4-billion/Mastodon

Quizá solo son presidentes haciéndose ricos a costa de su electorado. Pero las cripto son el vehículo perfecto para financiar campañas y esquivar las regulaciones tradicionales de financiación. De hecho, son un medio popular entre los grupos supremacistas, nazis y antisemitas americanos. Solo en 2023, la Liga Antidifamación llegó a certificar al menos 15 grupos de extrema derecha moviendo importantes cantidades en criptomonedas para sus actividades. En noviembre de 2020, varios activistas ultras recibieron medio millón de dólares en bitcoin de un donante francés, poco antes del asalto al Capitolio. El FBI cree que se usaron para financiar la operación.

Es improbable que la nueva Administración norteamericana siga investigando esos usos."

https://elpais.com/opinion/2025-02-24/la-nueva-criptoeconomia-de-la-ultraderecha.html

#Crypto #Cryptocurrencies #Memecoins #PonziScheme

La nueva criptoeconomía de la ultraderecha

Las ‘memecoins’ no pretenden tener un propósito tecnológico o financiero, son una estafa piramidal vinculada a la nueva red de gobiernos populistasMarta Peirano (Ediciones EL PAÍS S.L.)

#Linux #Crypto #Monero #ZANO #wownero #blog #cybersecurity #PrivacyMatters #PrivacyGuides #privacymattersmost #mastodon #gnulinux #anonymity #education #technology #tech

GRUB password for hard protection

Hello folks, in this blog you will learn how to add a layer of security to your Linux system by defining a password for your GRUB. This is a that very few d...Cypherpunk Dojo

https://www.citationneeded.news/coinbase-campaign-finance-violation/

#crypto #cryptocurrency #Coinbase #USpolitics #USpol

Coinbase appears to have violated campaign finance laws with a $25 million super PAC donation

Actively involved in contract negotiations with a federal government agency, Coinbase was likely prohibited from making its $25 million contribution to the Fairshake cryptocurrency-focused super PAC in May 2024.Molly White (Citation Needed)

#crypto #cryptocurrency #Coinbase #USpolitics #USpol

#MLMs #crypto #GetRichQuick

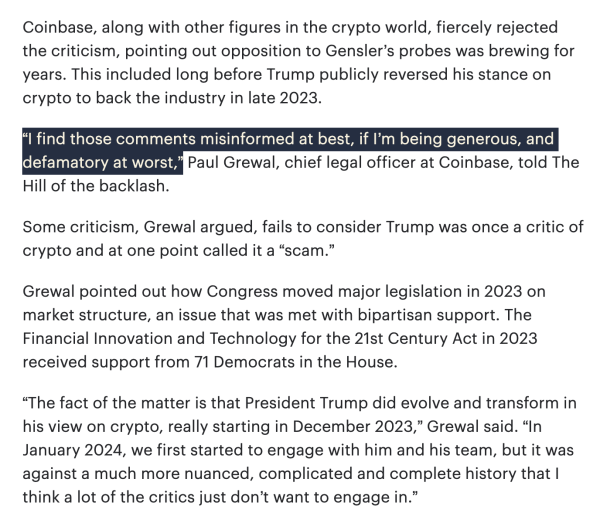

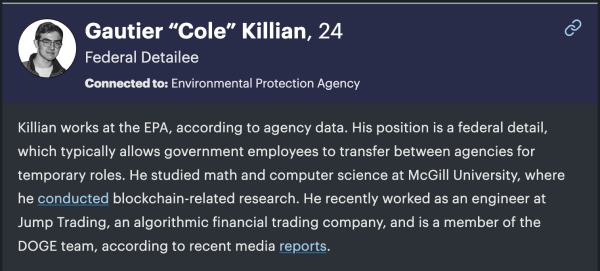

This seem to not be entirely correct - Cole Killian is a crypto bro who apparently worked at Jump's crypto subsidiary (cleverly named #JumpCrypto), a company which was notorious among traders for market manipulation and ended up getting whacked for over a hundred million dollars for financial crimes before having its CEO forced out (which is possibly why Mr. Killian has time to DOGE).

Among other things Jump Crypto was intimately involved in the spectacular collapse of the $40 billion Terra/Luna ponzi scheme, a financial cataclysm that ruined tens of thousands of people's lives.

Put less gently, no one who worked at Jump Crypto should be anywhere near any financial job ever again, period.

https://cryptadamus.substack.com/p/the-crypto-grifters-of-doge

#uspol #uspolitics #elonmusk #Trump #TerraLuna #crypto #NerdReich #networkState

The Crypto Grifters Of DOGE

How many crypto grifters does it take to screw up the machinery of state?Michel de Cryptadamus (The Cryptocalypse Chronicles)

Biden’s Policy Lead On Crypto Responds To Trump’s New Executive Order - EUROPE SAYS

Former U.S. President Joe Biden signed executive order 14067 on digital assets, setting the tone of ...EUROPE SAYS (EUROPESAYS.COM)

https://www.fastcompany.com/91266892/trump-meme-coin-cash-out-presidency

#tech #technology #news #technews #crypto #scam #news #politics #uspol #uspolitics #GOPCult #trump #corruption

1 Top Cryptocurrency to Buy Before It Soars 120%, According to a Former Goldman Sachs Analyst - EUROPE SAYS

XRP (CRYPTO: XRP), the native token of the Ripple blockchain, has skyrocketed 480% during the past three months.EUROPE SAYS (EUROPESAYS.COM)

...at least until a 'working group' figures out some details, anyway...

"#Trump has just said he is now signing an #executiveorder on #crypto" #btc #bitcoin #digitalcurrency

Details https://unusualwhales.com/news/trump-has-just-said-he-is-now-signing-an-executive-order-on-crypto-2

Trump has just said he is now signing an executive order on crypto

Today, President Donald Trump signed an executive order (EO) titled “Strengthening American Leadership in Digital Financial Technology,” marking a significant move in the cryptocurrency space.Unusual Whales

"First lady Melania Trump has launched a #cryptocurrency on the eve of her husband's inauguration as US president."

More: https://t.co/zGxjispHZy

#Crypto #BTC

@unusual_whales

Trump on $TRUMP meme coin, says "I don't know much about it other than I launched it. I heard it was very successful, I haven't checked it. Where is it today?"

Incoming First Lady Melania Trump has introduced her own cryptocurrency just ahead of her husband Donald Trump’s inauguration as U.S. president. The announcement follows the launch of the $Trump cryptocurrency by President-elect Donald Trump.Unusual Whales

Unprecedented Surge in Cryptocurrency! Is Donald Trump the Secret Ingredient? - EUROPE SAYS

The cryptocurrency market is experiencing a dramatic upheaval, fueled by Donald Trump’s recent U.S. election victory. Bitcoin hasEUROPE SAYS (EUROPESAYS.COM)

Crypto Trader Says One Factor Could Trigger Massive Breakout for Ethereum – Here’s His Outlook - EUROPE SAYS

Cryptocurrency trader and analyst Ali Martinez believes Ethereum (ETH) could have a massive breakout due to one keyEUROPE SAYS (EUROPESAYS.COM)

Crypto Trader Says One Factor Could Trigger Massive Breakout for Ethereum – Here’s His Outlook - EUROPE SAYS

Cryptocurrency trader and analyst Ali Martinez believes Ethereum (ETH) could have a massive breakout due to one keyEUROPE SAYS (EUROPESAYS.COM)

The eight fraud, market manipulation, and money laundering charges carry hefty maximum sentences, and Kwon stands accused of causing $40 billion in losses to at least hundreds of thousands, if not more than a million people. He’s entered a not guilty plea, as is to be expected this early on, and is likely to do a whole lot more sitting around in a jail cell as prosecutors and defense attorneys sift through discovery. “Sounds like we’re going to be backing up a U-Haul to the Southern District,” District Judge Paul Engelmayer joked about the apparent six terabytes of data, before scheduling the trial start date a whopping year away in January 2026 (while offering Kwon and his defense team the opportunity to request an earlier trial)."

https://www.citationneeded.news/issue-73/

#Crypto #Cryptocurrencies #Terra #StableCoins #Anchor #PonziScheme #Fraud #CyberCrime

Issue 73 – Degen volunteer fire brigade

Terra founder Do Kwon is finally extradited, the CFPB proposes crypto consumer protections, and Polymarket reaches new lows.Molly White (Citation Needed)

https://www.ft.com/content/8533f856-57f1-4765-a3dc-d866543092be

#FT #FinancialTimes #Alphaville #crypto #cryptocurrency #bitcoin #BTC #FTAV

#BTC #Bitcoin #BitcoinFraud #CryptoScams #scams

Whatever the story is, the results are the same. The damage done is not small. The idea that Crypto now uses more energy than many countries, when we should be conserving energy, is crazy.

We all have a choice when it comes to Crypto. I decided years ago not to get involved. If I had gotten involved, I would have made a bundle, but I would have been part of the problem and I did not want to do that.

Lets stay away from any products and services that include Crypto. Lets not support this "industry" in any way.

#Vivaldi #browser #Crypto #Bitcoin #DOGE

""If you lost all your money buying #crypto you deserve it" is just as accurate and a lot more concise!" 🤣

#BTC, a #SuckersGame for #Gamblers

#EatTheRich an anyone who'd want to be. Not #Satire. Cynical #Humor

Who were the 2024 election's "crypto voters"? - EUROPE SAYS

In last month's election, one of the biggest winners was not on the ballot — it was inEUROPE SAYS (EUROPESAYS.COM)

"#Crypto cash flooded the #election2024. Here's why and the impact it may have

https://www.cbsnews.com/video/crypto-cash-election-influence-60-minutes-video-2024-12-08

Who were the 2024 election's "crypto voters"?

https://www.cbsnews.com/video/who-were-the-2024-elections-crypto-voters" #BTC #RiggedElection

Who were the 2024 election's "crypto voters"?

A leading cryptocurrency executive told 60 Minutes crypto's success was not just because of the enormous amount of money the industry spent on ads. It was also because people they described as "crypto voters" turned out to cast their ballots.CBS News

#crypto #cryptocurrency #USpol #USpolitics

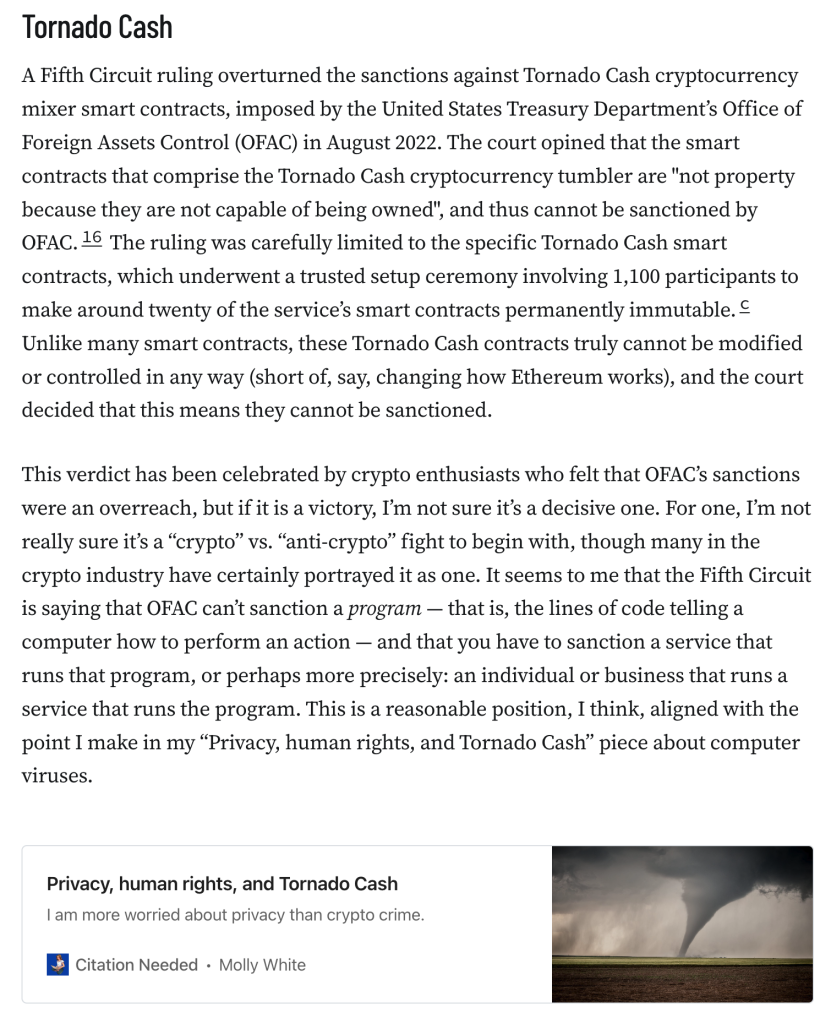

#crypto #cryptocurrency #TornadoCash

#crypto #cryptocurrency

#crypto #cryptocurrency

#crypto #cryptocurrency

https://www.citationneeded.news/issue-71/

#crypto #cryptocurrency

South Korea Crypto Market Collapses Following President Yoon’s Martial Law Announcement

South Korea’s crypto market plummeted after martial law was declared, with Bitcoin dropping 30% on Upbit. Crypto whales capitalized on market panic, transferring $163M USDT to seize discounted assets.BYTESEU (Bytes Europe)

#Celsius #crypto #cryptocurrency

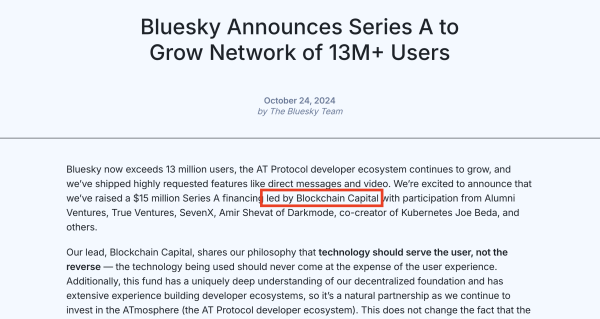

You don't have to take my word for it. Here's the official press release: https://bsky.social/about/blog/10-24-2024-series-a

Moving to BlueSky is not an escape. Growing a base there is just putting in a bunch of work to create a platform that will be co-opted by crypto bros as soon as X breaks in half.

p.s. crypto bros (#a16z) also own #Substack

#crypto #cryptocurrency #bitcoin #USDT #Trump #DonaldTrump

![Justin Sun

Pro tip: If you’re one of the shadiest players in the cryptocurrency industry and want to avoid mainstream press attention on your $30 million bribe to the US president-elect via his cryptocurrency grift, just spend another $6 million on a concept art piece involving a real banana, and eat it.d That stunt will land you no fewer than five New York Times articles (plus a letter to the editor) in the span of eight days, with not a single mention of the Trump contribution.

I will give his backstory as briefly as I can, but I’m afraid it won’t be very brief. In 2017, Chinese citizen and then-resident Justin Sun launched an ICO for his Tron project, raising $70 million days after China banned ICOs, and then fled the country. He bought BitTorrent and tried to turn it into a cryptocurrency company by merging it with Tron, shocking BitTorrent executives who realized that Sun’s “market making” operations were just blatant insider trading. He did another ICO, this time shopping for a lawyer who would agree to write a letter he hoped would shield him from liability if he was later sued by the US SEC (and he was [W3IGG]). He bought the Poloniex cryptocurrency exchange from Circle, after their attempt to turn it from “shitcoin casino numero uno” (as per a former employee) into a legitimate operation failed upon the realization that the lax standards were the whole selling point. Sun promised to return it to its original anything-goes glory, at one point screaming at an employee Justin Sun

Pro tip: If you’re one of the shadiest players in the cryptocurrency industry and want to avoid mainstream press attention on your $30 million bribe to the US president-elect via his cryptocurrency grift, just spend another $6 million on a concept art piece involving a real banana, and eat it.d That stunt will land you no fewer than five New York Times articles (plus a letter to the editor) in the span of eight days, with not a single mention of the Trump contribution.

I will give his backstory as briefly as I can, but I’m afraid it won’t be very brief. In 2017, Chinese citizen and then-resident Justin Sun launched an ICO for his Tron project, raising $70 million days after China banned ICOs, and then fled the country. He bought BitTorrent and tried to turn it into a cryptocurrency company by merging it with Tron, shocking BitTorrent executives who realized that Sun’s “market making” operations were just blatant insider trading. He did another ICO, this time shopping for a lawyer who would agree to write a letter he hoped would shield him from liability if he was later sued by the US SEC (and he was [W3IGG]). He bought the Poloniex cryptocurrency exchange from Circle, after their attempt to turn it from “shitcoin casino numero uno” (as per a former employee) into a legitimate operation failed upon the realization that the lax standards were the whole selling point. Sun promised to return it to its original anything-goes glory, at one point screaming at an employee](https://friendica-leipzig.de/photo/preview/1024/332906)

![Justin Sun has since amassed an even larger collection of companies, many of which he pretends he doesn’t own or control. These include the Huobi exchange (which he rebranded to HTX), BitGlobal, and the TrueUSD stablecoin project. In September 2023, Huobi/HTX was hacked for $8 million [W3IGG]. In October 2023, TrueUSD either lied about having no affiliation with a token called $TEURO, or the TrueUSD deployer was compromised [W3IGG]. In November 2023, Poloniex was hacked for over $120 million [W3IGG]. Less than two weeks later, Huobi/HTX and its Heco Chain project were hacked for $115 million [W3IGG]. In May 2024, Crypto Critics Corner put out an episode presenting a rather convincing argument that Justin Sun is insolvent. They also outlined the incredible shadiness around his companies’ “proofs of reserves”, including the fact that multiple of his companies seem to be counting the same pool of assets as reserves.23

The crypto community distrusts Sun so much that an August announcement that BitGlobal (and thus Sun) would be helping to manage custody for wrapped bitcoin (WBTC) caused a mass exodus from the token. MakerDAO enthusiastically voted to stop accepting WBTC as collateral (before changing their minds after assurance that Sun didn’t have as much influence over WBTC management as they initially thought). Coinbase announced their own wrapped bitcoin product to use instead, and delisted WBTC. Kraken also announced a wrapped bitcoin product. Justin Sun has since amassed an even larger collection of companies, many of which he pretends he doesn’t own or control. These include the Huobi exchange (which he rebranded to HTX), BitGlobal, and the TrueUSD stablecoin project. In September 2023, Huobi/HTX was hacked for $8 million [W3IGG]. In October 2023, TrueUSD either lied about having no affiliation with a token called $TEURO, or the TrueUSD deployer was compromised [W3IGG]. In November 2023, Poloniex was hacked for over $120 million [W3IGG]. Less than two weeks later, Huobi/HTX and its Heco Chain project were hacked for $115 million [W3IGG]. In May 2024, Crypto Critics Corner put out an episode presenting a rather convincing argument that Justin Sun is insolvent. They also outlined the incredible shadiness around his companies’ “proofs of reserves”, including the fact that multiple of his companies seem to be counting the same pool of assets as reserves.23

The crypto community distrusts Sun so much that an August announcement that BitGlobal (and thus Sun) would be helping to manage custody for wrapped bitcoin (WBTC) caused a mass exodus from the token. MakerDAO enthusiastically voted to stop accepting WBTC as collateral (before changing their minds after assurance that Sun didn’t have as much influence over WBTC management as they initially thought). Coinbase announced their own wrapped bitcoin product to use instead, and delisted WBTC. Kraken also announced a wrapped bitcoin product.](https://friendica-leipzig.de/photo/preview/600/332908)

![So all this to say: who better for Donald Trump’s World Liberty Financial to bring on as its newest “adviser”? All it took was Sun’s purchase of $30 million worth of WLFI tokens,e which appears to be about as blatant an attempt to get out of the SEC’s crosshairs as the election spending by Coinbase, Ripple, and others. I’ve mentioned WLFI’s disappointing sales in previous issues [I68, 69, 70], and indeed the project had only sold around $20 million worth of the WLFI tokens in total until Sun came along, so the $30 million purchase certainly caught Trump’s attention. World Liberty Financial announced his advisory position in a tweet that described Sun, as is his preference, as merely “an advisor to HTX” and “a supporter of BitTorrent”. It played up his attendance of the University of Pennsylvania, which would've seemed like a bizarre thing to mention if it wasn’t so clear that it was an attempt by WLFI to downplay that Sun is a Chinese national.24

Now, Sun is telling reporters: “In terms of the friendly level [for] the crypto business, I think we could even say the best [jurisdiction] is the U.S.“25 He’s certainly hoping to make it so, especially for his incredibly sketchy brand of “crypto business”. So all this to say: who better for Donald Trump’s World Liberty Financial to bring on as its newest “adviser”? All it took was Sun’s purchase of $30 million worth of WLFI tokens,e which appears to be about as blatant an attempt to get out of the SEC’s crosshairs as the election spending by Coinbase, Ripple, and others. I’ve mentioned WLFI’s disappointing sales in previous issues [I68, 69, 70], and indeed the project had only sold around $20 million worth of the WLFI tokens in total until Sun came along, so the $30 million purchase certainly caught Trump’s attention. World Liberty Financial announced his advisory position in a tweet that described Sun, as is his preference, as merely “an advisor to HTX” and “a supporter of BitTorrent”. It played up his attendance of the University of Pennsylvania, which would've seemed like a bizarre thing to mention if it wasn’t so clear that it was an attempt by WLFI to downplay that Sun is a Chinese national.24

Now, Sun is telling reporters: “In terms of the friendly level [for] the crypto business, I think we could even say the best [jurisdiction] is the U.S.“25 He’s certainly hoping to make it so, especially for his incredibly sketchy brand of “crypto business”.](https://friendica-leipzig.de/photo/preview/600/332910)

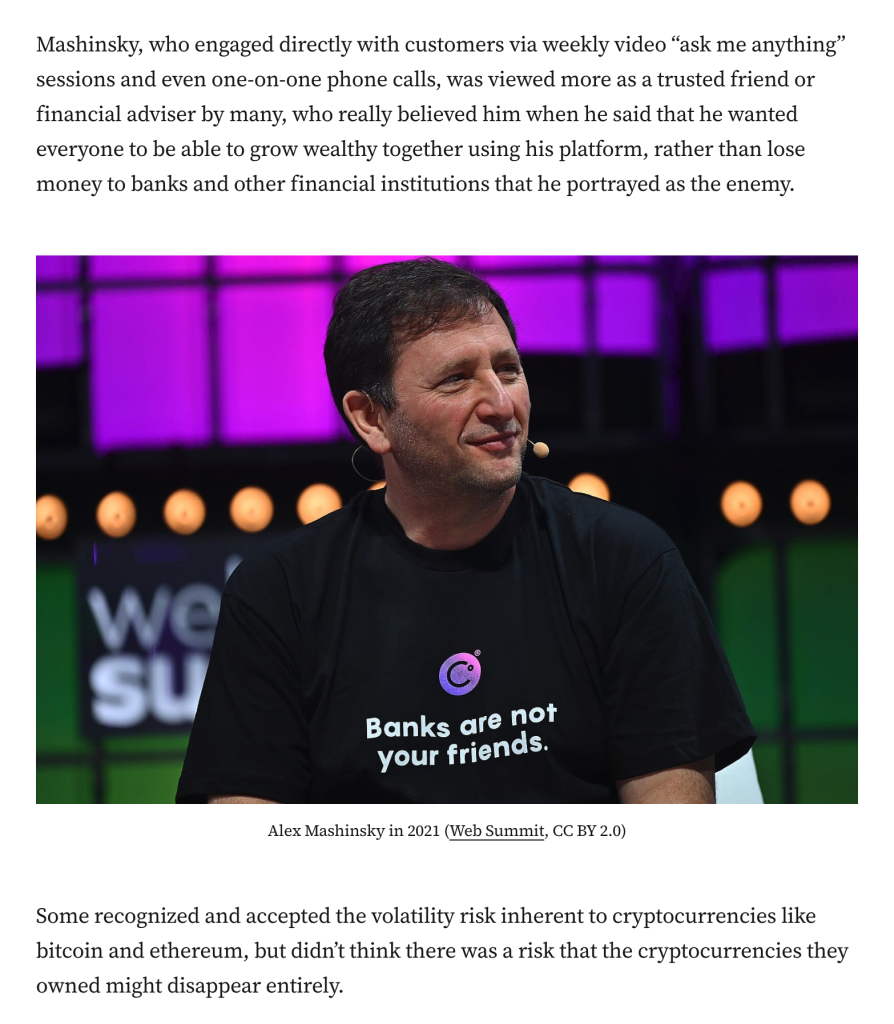

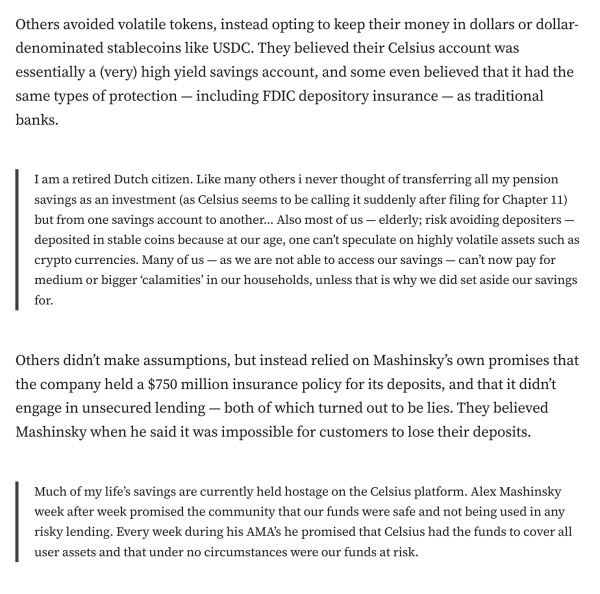

![The trial was set for late January, and I was curious about how Mashinsky would approach it. Mashinsky is sort of your classic conman, relying on his charisma and ability to talk in circles to pass off his often highly exaggerated pronouncements, if not blatant lies — like claiming to have invented decentralized finance, VoIP, and Uber.3 The combination of mendacity and narcissism reminds me of Sam Bankman-Fried, who remained convinced of his ability to talk his way out of his fraud charges until — and perhaps after — his conviction and sentencing. Their similarities made me wonder if Mashinsky might also take the stand in his own defense.

Mashinsky seems to have proven more willing than Bankman-Fried to listen to the advice of his lawyers, and agreed to this plea deal soon after failing to have two of the charges against him dismissed before trial [I70]. In exchange for a guilty plea to two of the seven charges, commodities fraud and securities fraud, he will forfeit $48 million and face a maximum sentence of 30 years in prison — though he’s likely to get less. The trial was set for late January, and I was curious about how Mashinsky would approach it. Mashinsky is sort of your classic conman, relying on his charisma and ability to talk in circles to pass off his often highly exaggerated pronouncements, if not blatant lies — like claiming to have invented decentralized finance, VoIP, and Uber.3 The combination of mendacity and narcissism reminds me of Sam Bankman-Fried, who remained convinced of his ability to talk his way out of his fraud charges until — and perhaps after — his conviction and sentencing. Their similarities made me wonder if Mashinsky might also take the stand in his own defense.

Mashinsky seems to have proven more willing than Bankman-Fried to listen to the advice of his lawyers, and agreed to this plea deal soon after failing to have two of the charges against him dismissed before trial [I70]. In exchange for a guilty plea to two of the seven charges, commodities fraud and securities fraud, he will forfeit $48 million and face a maximum sentence of 30 years in prison — though he’s likely to get less.](https://friendica-leipzig.de/photo/preview/600/332892)