Suche

Beiträge, die mit Marx getaggt sind

#lesezeichen #marx #karlmarx #alexandrakollontai #analysen #theorie #sachbuch #linketheorie #welovebooks #verlage #bücher #lbm25 #leipzigerbuchmesse

#FreePalestine #palestine #btw2025,#btw2025, #sozialismus #antifaschismus, #marx, #lenin

https://youtube.com/shorts/4qtT58_wqFo

- YouTube

Auf YouTube findest du die angesagtesten Videos und Tracks. Außerdem kannst du eigene Inhalte hochladen und mit Freunden oder gleich der ganzen Welt teilen.youtube.com

#Marxists don't condemn industrial development controlled by #oligarchy as long as that oligarchy is the same as that of the party.

#Marx & #Engels if alive again they would waste their second lives criticizing the clergy built around #Marxism and their interpretive idealism, against any critical thought and materialism.

#1stInternational revisited

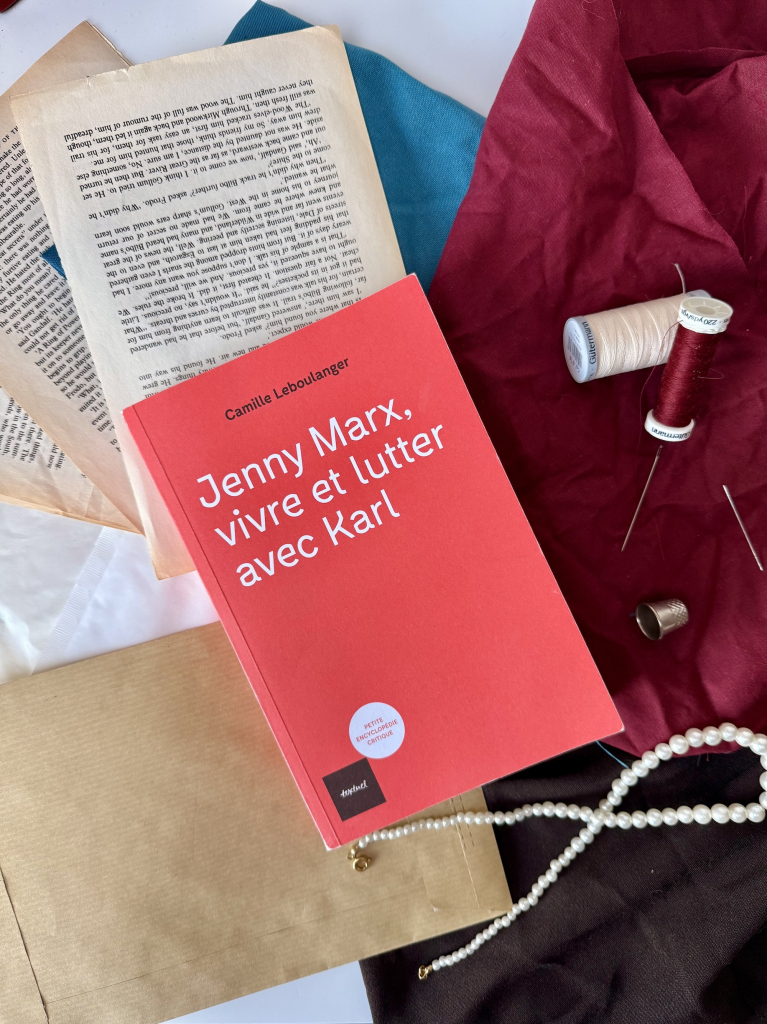

Entre essai et parties romancées, cette biographie de Jenny Marx se lit sans peine, même pour une néophyte comme moi. À travers elle, c’est la fresque d’une époque mouvementée qui se dessine mais aussi la condition des femmes de l’époque. Une découverte fort intéressante d’une personnalité remarquable qui rappelle le collectif sous le nom.

Retrouvez mon avis complet de non-experte du sujet sur le blog: https://yuyine.be/node/1303

#blog #critique #critiquelitteraire #bookreview #book #books #livre #lecture #Pixelbook #essai #biographie #JennyMarx #Marx #CamilleLeboulanger #Textuel

Jenny Marx, vivre et lutter avec Karl

Le 26 février, les éditions Textuel publieront un nouveau titre dans leur collection Petite encyclopédie critique signé par Camille Leboulanger, auteur que j’apprécie pour ses romans d’imaginaire.Les critiques de Yuyine

#anarchism #anarchy #anarchist #IainMBanks #TheCultureNovels #TheCulture #poli #politics #PoliSci #Marxism #Marx #socialism #communism

Then we move onto the media and internet reaction to the murder of CEO Brian Thompson, the folk hero status of our man #Luigi, and a general critique of insurance and society from a #workingclass, #proletarian perspective.

#socialMurder #prole #marx #UnitedHealthcare #ceo #LuigiMangione

#BrianThompson #justice

https://youtu.be/fdDmyhqCvaw?si=CKuAeABn4dq_ncLb

https://marxandphilosophy.org.uk/reviews/21758_marxs-not-capital-labour-and-the-contemporary-critique-of-political-economy-by-benjamin-tetler-reviewed-by-will-berrington/

#Marx #CriticalTheory #Capital #Labour #Capitalism

‘Marx’s Not-Capital: Labour and the Contemporary Critique of Political Economy’ by Benjamin Tetler reviewed by Will Berrington

Readers can be forgiven for thinking Ben Tetler’s Marx’s Not-Capital ends on a slightly deflationary note.marxandphilosophy.org.uk

#communism #manifest #workersrights #Marx #Engels #history #study for #future

Manifesto of the Communist Party

Manifesto issued by Marx in 1848, regarded as founding documents of Communismwww.marxists.org

On the inevitable end of capitalism

...

As Karl Marx (1818–1883) wrote, ‘the apologists content themselves with denying the catastrophe itself and insisting, in the face of their regular and periodic recurrence, that if production were carried on according to the textbooks, crises would never occur’.

There is an interesting anecdote that sheds light on this divorce between theory and reality in mainstream bourgeois economics. After the 2008 global financial crisis, Queen Elizabeth II of the United Kingdom visited the illustrious London School of Economics and Political Science (LSE). Like a naïve child asking the most untoward question in polite company, she asked the eminent economists gathered for the occasion – among them professors at the most prestigious universities, government advisers, and pundits for highly regarded organs of the financial press such as The Economist and Financial Times – the following question: ‘Why did no one see it coming?’. There was no satisfactory reply. The duty of these eminent economists, up until the 15 September 2008 collapse of Lehman Brothers, had been to defend the impeccably rational functioning of markets in the face of criticism from their hapless less orthodox colleagues, choosing not to reply to Marxist criticism so as not to lend it legitimacy.

...

The more finance oils the machinery of a moribund economy, the more debt accumulates. In the end, financial flows reach a magnitude that is disproportionate when compared to the productive base that has given birth to all the credit and market capitalisation that have been amassed. Thus, the later the crash, the worse the outcome. This is what happened in 2008 and – based on an examination of the economic data in the years since – will, in all probability, repeat itself again in the short- or medium-term.

...

However, this creates a contradiction for capital. Most of the time, the advancement in techniques involves the incorporation of new machines and more expensive materials into the production process. Thus, constant capital – i.e., the plant, machinery, other equipment, auxiliary elements such as energy, and other similar expenses – increase in relation to living labour. What Marx calls the technical composition and the organic composition of capital (the difference need not detain us here), i.e., the ratio of constant capital to living labour, increases as well. However, the basic Marxist proposition concerning value posits that the source of all value, and therefore of surplus value, is living labour. As capital strives to increase the amount of surplus value, it is thereby ejecting from the production process the very source of value, i.e., labour.

...

We have thus come to the end of a rather long journey of explaining the mechanism behind crises and, by extension, the current crisis. But pressing questions remain: why are there depressions? Why have depressions become the most salient but also the most destructive form of capitalist crises over the last 150 years? To answer these questions, we will look to Marx’s grand vision of historical change, of how humanity moves from one mode of production, one socioeconomic formation, to another.

...

At the beginning of the passage from Capital quoted above, Marx emphasised the fact that the entire process of capital accumulation advances through ‘the immanent laws of capitalistic production itself’. In Capital, Marx traced the historical development of capitalism and established the laws that determine how a society based on capital functions. That is why Marx constantly talks of ‘necessity’: once established, capitalism necessarily proceeds towards its own demise on the basis of its own laws. In other words, through its very laws, capitalism generates, within its bosom, the forces that will destroy it. The effects of these laws may be mitigated, temporarily arrested, or even reversed for a certain period. However, as long as capitalism exists, as long as it develops according to its own inherent laws, at a certain stage of its development, it will undermine its own existence. Capitalism, in other words, creates the historical conditions for its own demise.

...

Silvio Ghesell is mentioned in the article, but he is unnecessarily overlooked.

See more: Freigeld - free money

#freigeld

#economy #economics #Marx #capitalism #crisis #financecrisis #finances #finance #money

The World in Economic Depression: A Marxist Analysis of Crisis

Español PortuguêsNotebook no. 4 Notebook no. 4 was researched and written by E. Ahmet Tonak (an economist at Tricontinental: Institute for Social Research) and Sungur Savran (an instructor at Istanbul Okan University and editor of Devrimci Marksizm a…Amilcar (Tricontinental: Institute for Social Research)