Suche

Beiträge, die mit politicaleconomy getaggt sind

For example: capital is reluctant to enter industries that are easy to enter, for fear competition will drive out the profit. The abundant solution to a lack of housing is to make it easier for developers to build for increased density: the more units that come onto the market, the less landlords will be able to charge. But the same supply mechanism that pushes down prices discourages capital from the sector."

https://thebaffler.com/latest/whats-the-matter-with-abundance-harris

#Abundance #Liberalism #Capitalism #PoliticalEconomy #Degrowth

What’s the Matter with Abundance? | Malcolm Harris

“Abundance” by Ezra Klein and Derek Thompson is new packaging for a tried-and-failed attempt to escape from history on a rocket ship.J.W. McCormack (The Baffler)

"Canada is the second-largest country by land mass, with the world’s longest coastline. It is bookended by the Pacific and Atlantic oceans, making it ideally situated for global trade.

Marko Papic, chief strategist at BCA Research, also reckons Canada could be better off in a warmer world. “Global warming could increase agricultural yields, open up large swaths of the country to mineral exploration, and allow for new trade routes through the Arctic,” he said.

The country is energy independent, with the world’s largest deposits of high-grade uranium and the third-largest proven oil reserves. It is also the fifth-largest producer of natural gas.

Canada boasts a huge supply of other commodities too, including the largest potash reserves (used to make fertiliser), over one-third of the world’s certified forests and a fifth of the planet’s surface freshwater. Plus, it has an abundance of cobalt, graphite, lithium and other rare earth elements, which are used in renewable technologies.

“Canada absolutely has potential to be a global superpower,” added Papic. But the nation has lacked the visionary leadership and policy framework to capitalise on its advantages.

US President Donald Trump’s tariff threat has, however, shifted the Overton window. There is now a growing political consensus to unlock Canada’s economic potential and reduce its dependence on exports to its southern neighbour. That task will fall to either Prime Minister Mark Carney or opposition leader Pierre Poilievre following an election this year.

Canada’s GDP has long trailed its G7 peers, ranking 16th globally in purchasing power parity terms. A country with its geography could clearly generate higher output. To do so, the Canadian economy needs to become more efficient, raise investment and attract more high-skilled workers. Here’s how."

https://www.ft.com/content/d4813838-66b2-4823-8361-11d467142fd2

#Canada #USA #Trump #Tariffs #TradeWar #PoliticalEconomy #Geopolitics

Unlocking Canada’s superpower potential

Capitalising on the G7 nation’s vast geography could spark an economic boomTej Parikh (Financial Times)

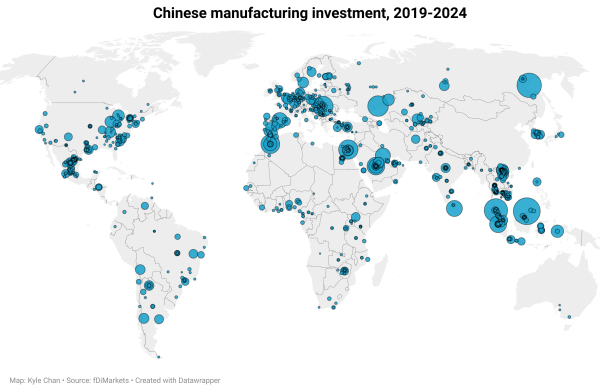

And, like Japan before it, China is using these economic linkages to support its own national interests while framing them as mutually beneficial partnerships. China is not the only country that loves using the phrase “win-win” when describing international partnerships. Shinzo Abe used it frequently when talking about Japan’s relationship with the US, EU, Russia, Asia, and of course China. For decades, Japan claimed credit for using aid and investment to help its Asian neighbors develop economically while turning the region into Japan’s manufacturing backyard. Throughout this whole process, Japan was careful to maintain control over core technology and prevent technology “leakage” to other countries. Now China is doing many of the same things with a similar framing.

But there is one important difference. China appears willing to leverage its control over technology, machinery, and critical inputs to actively undermine the industrial development of other countries—India being the prime example. In a not-so-ironic twist, China’s approach looks more like that of another great power, namely US efforts to cut out China."

https://www.high-capacity.com/p/china-is-trying-to-reshape-global

#China #PoliticalEconomy #Imperialism #Manufacturing #SupplyChains

China is trying to reshape global supply chains

China is using "industrial diplomacy" and technology controls to create new China-friendly global production networks centered around China.Kyle Chan (High Capacity)

https://www.newyorker.com/culture/infinite-scroll/techno-fascism-comes-to-america-elon-musk

#TechnoFascism #USA #BigTech #SiliconValley #Japan #PoliticalEconomy

But tariffs are only the first phase of his masterplan. With high tariffs as the new default, and with foreign money accumulating in the Treasury, Trump can bide his time as friends and foes in Europe and Asia clamour to talk. That’s when the second phase of Trump’s plan kicks in: the grand negotiation.

Unlike his predecessors, from Carter to Biden, Trump disdains multilateral meetings and crowded negotiations. He is a one-on-one man."

https://unherd.com/2025/02/why-trumps-tariffs-are-a-masterplan/

#USA #Trump #Tariffs #TradeWar #PoliticalEconomy #Protectionism

https://youtu.be/M09HA9CdmJ0

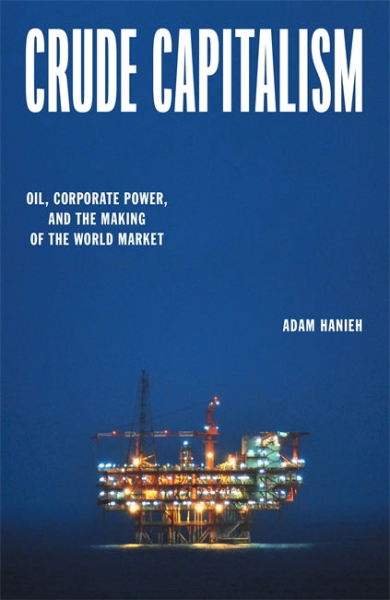

"His new book, #CrudeCapitalism: #Oil, Corporate Power, and the Making of the World Market is out now with #VersoBooks: https://www.versobooks.com/en-ca/products/2760-crude-capitalism?utm_campaign=crude_capitalism_25&utm_medium=social&utm_source=youtube "

#Palestine #MiddleEast #MiddleEastPolitics #imperialism #PoliticalEconomy #petropolitics #geopolitics #ArabPolitics #PoliticalTheory #ArabMarxism #books @palestine @bookstodon

Crude Capitalism

This expansive history traces the hidden connections between oil and capitalism from the late 1800s to the current climate crisis.Verso

China’s 10-year bond yield, a benchmark for economic growth and inflation expectations, fell to a record low of less than 1.6 per cent during trading last week and has since hovered close to that level.

Crucially, the whole yield curve has shifted downwards rather than steepening, suggesting investors are alarmed about the long-term outlook and not just anticipating short-term cuts to interest rates.

“For the long-term [bonds], yields have been trending down and I think that’s more about longer-term growth expectations and inflation expectations becoming more pessimistic. And I think that trend is likely to continue,” said Hui Shan, chief China economist at Goldman Sachs."

https://www.ft.com/content/6fe07039-eb7d-47d9-8e97-e933bab0085a

#China #Economy #Deflation #PoliticalEconomy

Falling Chinese bond yields signal concern with deflation

Investors expect price pressures to become entrenched in world’s second-largest economyArjun Neil Alim (Financial Times)

An even more significant example is infant-industry protection, which has worked best when it exists alongside other instruments to incentivize domestic firms to innovate and upgrade. Some notable cases include the late-nineteenth-century United States, post-1960s South Korea and Taiwan, and post-1990s China. In each of these cases, industrial policies went far beyond trade protection, and it is unlikely that tariff barriers on their own would have produced the gains each of these economies experienced.

Similarly, green policies often require some trade barriers to make them economically and politically viable, as in the case of the European Union’s carbon tariffs and the local-content requirements of the US Inflation Reduction Act. In all these cases, tariffs play a supporting role for other policies that serve a broader purpose, and can be a small price to pay for the larger benefit.

Unfortunately, Trump has not offered a domestic agenda of renewal and economic reconstruction in any of these areas, and his tariffs will likely stand – and fail – on their own."

https://www.project-syndicate.org/commentary/trump-has-wrong-concept-of-tariffs-by-dani-rodrik-2025-01

#USA #Trump #Protectionism #TradeWars #Tariffs #PoliticalEconomy

What Tariffs Can and Can’t Do | by Dani Rodrik - Project Syndicate

Dani Rodrik argues that import duties are neither an all-purpose tool, as Donald Trump believes, nor a purposeless one.Project Syndicate

Among the bright spots in this bleak scenario are China and India with estimated growth rates of 4.5 per cent and 6.5 per cent respectively in 2025. There are other economies with faster growth but they do not matter for global output as their share of output in the world economy is very small."

https://openthemagazine.com/cover-stories/a-fragmenting-world/

#Globalization #Protectionism #TradeWars #PoliticalEconomy #GeoEconomicFragmentation

A Fragmenting World

Are we about to see the end of three decades of global economic integration?Siddharth Singh (Open The Magazine)

https://marxandphilosophy.org.uk/reviews/21887_history-of-capitalist-transformation-a-critique-of-liberal-capitalist-reforms-by-giampaolo-conte-reviewed-by-julia-bradley/

#Capitalism #Liberalism #EconomicHistory #Reformism #PoliticalEconomy

‘History of Capitalist Transformation: A Critique of Liberal-Capitalist Reforms’ by Giampaolo Conte reviewed by Julia Bradley

‘Liberal’ and ‘capitalist’ paired as a hyphenated compound word seems like an oxymoron, leaving one to wonder, what do civil liberties and democracy have to do with an economic system that often infringes on the aforementioned liberal defining charac…marxandphilosophy.org.uk

👉 "The next question is whether the protectionist policies espoused by Mr. Trump can save the people who are asking for his help. Unfortunately, the trade wars of the 1930s suggest the answer is probably “No.”

In the 1930s, the global economy was thrown into turmoil by the sharp increases in US import duties implemented in 1930 under the Smoot-Hawley Tariff Act and the retaliatory tariffs by other nations that followed. The value of global trade plunged 66% from the peak, and economies around the world suffered heavily.

The resulting economic turmoil eventually led to World War II. The US, which got through the greatest tragedy in human history by mobilizing its military capabilities, decided the world must never repeat this mistake. To that end, it introduced the system of free trade symbolized by the 1947 GATT (General Agreement on Tariffs and Trade).

This US-led free trade system produced unprecedented prosperity for humanity, but cracks began to appear when the nature of the currency market changed after the developed nations began liberalizing capital flows in 1980.

Today, just as in the 1930s, free trade is facing a potential crisis in the form of a sharp increase in US tariffs. If the authorities seriously wish to avoid this outcome, I think the nations of the world must come together and carry out an exchange rate adjustment similar to the Plaza Accord." 👈

https://www.ineteconomics.org/perspectives/blog/trump-tariffs-and-exchange-rates-the-message-of-elections-in-the-us-and-japan

#USA #Trump #Protectionism #FreeTrade #USTariffs #TradeWar #PoliticalEconomy #MonetaryPolicy #EconomicHistory

https://www.ineteconomics.org/perspectives/blog/trump-tariffs-and-exchange-rates-the-message-of-elections-in-the-us-and-japan

Trump, Tariffs, and Exchange Rates: The Message of Elections in the US and Japan

What Japan, the US, and Europe have in common is growing popular anger over the economy despite high stock prices and low unemployment.Institute for New Economic Thinking