Suche

Beiträge, die mit CryptoCurrency getaggt sind

https://thehill.com/policy/technology/5170036-trump-sec-crypto-industry-changes/

#Coinbase #crypto #cryptocurrency

The Svobodnaya Pressa website published an article on cryptocurrency by V. Katasonov —

In it we find curious data, so the author reports:

“A significant part of all information and communication technologies is realized precisely in the sector of non-productive, redistributive services. This is, first of all, electronic banking (EB) and electronic commerce (EC). This is by far the main part of the “digital economy”. But ultimately, the goal of “digitalization” of banking and commerce is to increase profits. And profit, as we know, is a centuries-tested tool with which capitalists redistribute the social product in their favor. Profit is the legalized stealing of society under capitalism. There can be no question of increasing the “public welfare””.

The author goes on to point out that the digital economy is by no means as harmless a phenomenon as it may seem at first glance. First, it draws away a significant number of the working-age population:

“There are only expert estimates available for employment in the 'digital casino'. Worldwide, the number of people employed in mining is already in the tens of millions. So far, this type of activity is mainly of a “gray”, “shadow” nature”.

Secondly, the “mining” (mining) of virtual money consumes a significant amount of energy resources:

“The insanely high energy intensity of digital mining has long been written and talked about by many experts. For many individual “miners” (those who “mine” cryptocurrency), the costs of “mining” become unaffordable. They begin to “optimize” them by, for example, stealing electricity. Or by moving their “mining” capacities to countries with lower electricity tariffs. But the main way has become what textbooks on the Marxist political economy of capitalism call “concentration” and “monopolization” of production and capital. What is happening is the consolidation of individual “miners” into “pools”. Bitcoin mining today is dominated by three large pools, which account for 55% of all computing power. In fact, there is a rapid monopolization in the field of cryptocurrencies.

According to statistics from the Digiconomist information and analytical center, at the end of last year, the annualized energy consumption of the bitcoin network reached 35.77 TWh. This is more than the annualized energy consumption of Denmark (33 TWh), Belarus (33.8 TWh) or Bulgaria (34.9 TWh). A year ago, bitcoin accounted for 0.16% of global electricity consumption. By the end of this year, that share is projected to rise to 0.5%. And with many other cryptocurrencies available, the “digital casino” could currently siphon off as much as 1 percent of all electricity generated globally. Obviously, the estimates are very rough, primarily because some of the electricity is siphoned off illegally. But the trend is obvious: the cryptocurrency “parasite” will increase both in absolute and relative terms the scale of such energy “sucking”.”

“Indeed,” the author summarizes, ‘the real price that humanity will have to pay for its dangerous games called ’digital economy' is infinitely high. “The digital economy is leading to the destruction of the real economy by parasitically sucking out of it very real resources - human, energy and financial resources.”

Having collected good data, Katasonov, being a bourgeois-patriotic economist, makes false political conclusions. The meaning of the author's position: stop parasitizing on the electric industry, go to work in factories. Here the well-known trick of dividing the bourgeoisie into “industrious producers” and “speculators-parasites” is used, of course, in order to support the former against the latter.

The proletariat needs to get rid not of any kind or subspecies of capitalists, but of the DICTATURE OF THE BURJUAZI as a class. The aim of every capitalist is not to satisfy the needs of the population, as it is written in textbooks, but to satisfy the thirst for maximum profit, so if it is more profitable for a capitalist to invest capital in a “crypto-farm” than in building a factory, he will organize a “crypto-farm”, and he doesn't care what the consequences for society will be. The problem of capitalism is not the wrong capitalists, but the OBJECTIVE LAWS of the economy, which produce TYRANNY towards the proletariat and the people as a whole.

“Mining” is a socially useless industry - a typical regurgitation of the market economy, it can be compared to rent, stock speculation or a thousand other legitimate phenomena of capitalism. Getting rid of the “parasitic” types of capitalists (in fact ALL of them are parasites) is the desire of their competitors for more profit, i.e. it is not in the interests of the proletariat.

However, the political danger of “mining” is the growth and support of petty-bourgeois sentiment, which is very favorable to the capitalist class as a whole. The more people believe that it is possible to survive without working for corporations, the more stable capitalism as a whole is. This is why bourgeois states look at cryptocurrencies leniently, and in some cases even support them.

Marx, as we know, called the petty bourgeoisie a disappearing stratum, and indeed in market conditions the petty bourgeois have one fate - proletarianization, but they continue to exist mainly due to the “social” policy of bourgeois states, which see them as a social pillar of capitalism.

In addition, bourgeois states poorly regulate cryptocurrencies because of the laundering of criminal proceeds, and the mafia has a large lobby in almost all bourgeois countries.

#lang_en

О криптовалюте

На сайте «Свободной прессы» вышла статья В. Катасонова о криптовалюте —

В ней мы находим любопытные данные, так автор сообщает:

«Значительная часть всех информационно-коммуникационных технологий реализуется именно в секторе непроизводительных, перераспределяющих услуг. Это, прежде всего, электронный банкинг (ЭБ) и электронная коммерция (ЭК). Это на сегодняшний день основная часть „цифровой экономики“. Но, в конечном счете, целью „цифровизации“ банковского и торгового дела является наращивание прибыли. А прибыль, как известно, и есть проверенный веками инструмент, с помощью которого капиталисты перераспределяют общественный продукт в свою пользу. Прибыль — узаконенное при капитализме обворовывание общества. Ни о каком приумножении „общественного благоденствия“ речи быть не может».

Далее автор указывает, что «цифровая экономика» отнюдь не такое безобидное явление, как это может показаться на первый взгляд. Во-первых, она оттягивает значительное число трудоспособного населения:

«Имеются лишь экспертные оценки по занятости в „цифровом казино“. По всему миру число занятых майнингом уже исчисляется десятками миллионов человек. Пока данный вид деятельности носит в основном „серый“, „теневой“ характер».

Во-вторых, «добыча» (майнинг) виртуальных денег пожирает значительное число энергоресурса:

«О безумно высокой энергоемкости цифрового майнинга уже давно писали и говорили многие эксперты. Для многих индивидуальных „шахтеров“ (те, кто „добывает“ криптовалюту) издержки „добычи“ становятся не подъемными. Они начинают „оптимизировать“ их, занимаясь, например, кражей электроэнергии. Или выводя свои мощности по „добыче“ в страны с более низкими тарифами на электричество. Но магистральным путем стало то, что в учебниках по марксистской политэкономии капитализма называется „концентрацией“ и „монополизацией“ производства и капитала. Происходит объединение индивидуальных „шахтеров“ в „пулы“. В майнинге биткойна сегодня доминирует три крупных пула, на которые приходится 55% всей вычислительной мощности. Фактически в сфере криптовалют происходит стремительная монополизация.

Согласно статистике информационно-аналитического центра Digiconomist, на конец прошлого года энергопотребление сети биткойн в приведении к годовому счислению достигло 35,77 ТВт/ч. Это больше, чем годовое энергопотребление Дании (33 ТВт/ч), Беларуси (33,8 ТВт/ч) или Болгарии (34,9 ТВт/ч). Год назад на биткойн приходилось 0,16% мирового потребления электроэнергии. На конец этого года прогнозируется, что эта доля увеличится до 0,5%. А с учетом того, что имеется множество других криптовалют, „цифровое казино“ в настоящее время может отсасывать до 1 процента всей электроэнергии, генерируемой в мире. Очевидно, что оценки очень приблизительные, прежде всего потому, что часть электроэнергии отсасывается нелегально. Но тенденция очевидна: криптовалютный „паразит“ будет наращивать и в абсолютном, и в относительном выражении масштабы такого энергетического „отсоса“».

«Действительно, — подытоживает автор, — реальная цена, которую человечеству придется заплатить за свои опасные игры под названием „цифровая экономика“, бесконечно высока. „Цифровая экономика“ ведет к разрушению реальной экономики путем паразитического высасывания из нее вполне реальных ресурсов — человеческих, энергетических и финансовых».

Собрав неплохие данные, Катасонов, будучи буржуазно-патриотическим экономистом, делает ложные политические выводы. Смысл позиции автора: долой паразитирование на электрике, идите работать на заводы. Здесь пускается в ход известный трюк с разделением буржуазии на «трудолюбивых производителей» и «спекулянтов-паразитов», разумеется, с целью поддержки первых против вторых.

Пролетариату необходимо избавиться не от каких-то видов или подвидов капиталистов, а от ДИКТАТУРЫ БУРЖУАЗИИ как класса. Цель всякого капиталиста не в удовлетворении потребностей населения, как это пишут в учебниках, а в удовлетворении жажды максимальной прибыли, поэтому если капиталисту выгоднее вложить капитал в «криптоферму», чем в строительство завода, то он организует «криптоферму», и плевать ему на то, какие будут последствия для общества. Проблематика капитализма состоит не в неправильных капиталистах, а в ОБЪЕКТИВНЫХ ЗАКОНАХ экономики, которые порождают ТИРАНИЮ по отношению к пролетариату и народу в целом.

«Майнинг» есть отрасль общественно-бесполезная — типичная отрыжка рыночной экономики, его можно сравнить с рентой, биржевыми спекуляциями или тысячью других закономерных явлений капитализма. Избавление от «паразитических» типов капиталистов (на самом деле ВСЕ они паразиты) является стремлением их конкурентов к большей прибыли, т. е. не отвечает интересам пролетариата.

Однако же политическая опасность «майнинга» состоит в росте и поддержке мелкобуржуазных настроений, что весьма выгодно капиталистическому классу в целом. Чем больше людей верят, что можно выжить без работы на корпорации, тем устойчивее капитализм в целом. Именно поэтому буржуазные государства смотрят на криптоденьги снисходительно, а кое-где даже оказывают поддержку.

Маркс, как известно, называл мелкую буржуазию исчезающей прослойкой, и действительно в рыночных условиях у мелких буржуа одна судьба — пролетаризация, однако они продолжают существовать в основном благодаря «социальной» политике буржуазных государств, которые видят в них социальную опору капитализма.

Кроме того, буржуазные государства слабо регулируют криптовалюты из-за отмывки преступных доходов, а мафия имеет крупное лобби практически во всех буржуазных странах.

#lang_ru

(2018)

#economy #mining #cryptocurrency #finance #capitalism #study for #future

О криптовалюте

О криптовалюте На сайте «Свободной прессы» вышла статья В. Катасонова о криптовалюте — http://sss.agybvxkyyg.cgxa.fr2.gsr.awhoer.diaspora* social network

https://www.citationneeded.news/coinbase-campaign-finance-violation/

#crypto #cryptocurrency #Coinbase #USpolitics #USpol

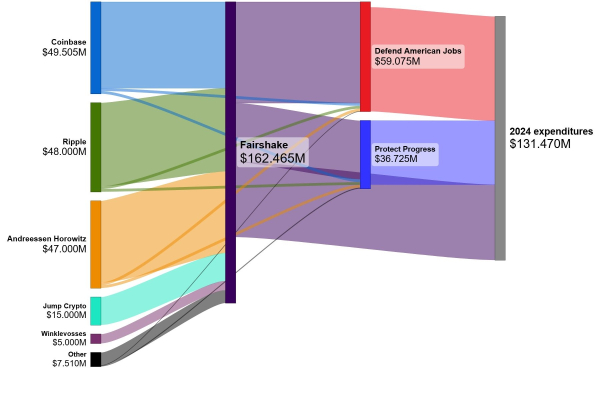

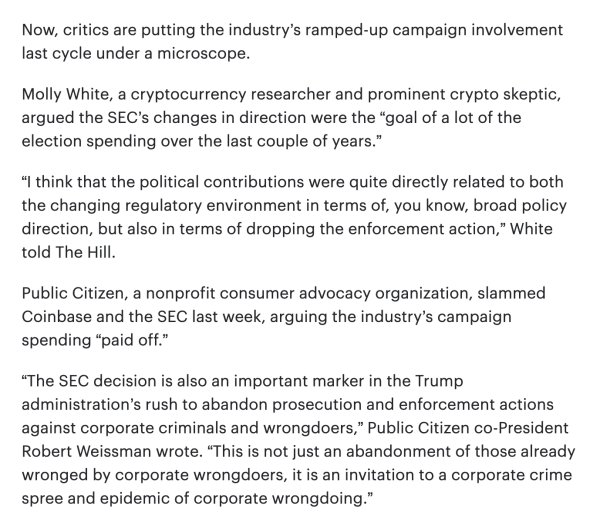

Coinbase appears to have violated campaign finance laws with a $25 million super PAC donation

Actively involved in contract negotiations with a federal government agency, Coinbase was likely prohibited from making its $25 million contribution to the Fairshake cryptocurrency-focused super PAC in May 2024.Molly White (Citation Needed)

#crypto #cryptocurrency #Coinbase #USpolitics #USpol

Biden’s Policy Lead On Crypto Responds To Trump’s New Executive Order - EUROPE SAYS

Former U.S. President Joe Biden signed executive order 14067 on digital assets, setting the tone of ...EUROPE SAYS (EUROPESAYS.COM)

1 Top Cryptocurrency to Buy Before It Soars 120%, According to a Former Goldman Sachs Analyst - EUROPE SAYS

XRP (CRYPTO: XRP), the native token of the Ripple blockchain, has skyrocketed 480% during the past three months.EUROPE SAYS (EUROPESAYS.COM)

"First lady Melania Trump has launched a #cryptocurrency on the eve of her husband's inauguration as US president."

More: https://t.co/zGxjispHZy

#Crypto #BTC

@unusual_whales

Trump on $TRUMP meme coin, says "I don't know much about it other than I launched it. I heard it was very successful, I haven't checked it. Where is it today?"

Incoming First Lady Melania Trump has introduced her own cryptocurrency just ahead of her husband Donald Trump’s inauguration as U.S. president. The announcement follows the launch of the $Trump cryptocurrency by President-elect Donald Trump.Unusual Whales

I hate to say it, but there are a lot of people who believe that they can make their fortune by diligently doing nowt other than 'investing'. And there are investments and 'investments'. And of course in with the herd, there are a substantial group who KNOW they can make their fortunes by bleading the suckers dry.

https://www.theguardian.com/technology/2025/jan/20/donald-trump-meme-coin-price-melania-token

#CryptoCurrency #Lunacy #MoneyForNothing #OneBornEveryMinute #Finance #Economics

Unprecedented Surge in Cryptocurrency! Is Donald Trump the Secret Ingredient? - EUROPE SAYS

The cryptocurrency market is experiencing a dramatic upheaval, fueled by Donald Trump’s recent U.S. election victory. Bitcoin hasEUROPE SAYS (EUROPESAYS.COM)

Crypto Trader Says One Factor Could Trigger Massive Breakout for Ethereum – Here’s His Outlook - EUROPE SAYS

Cryptocurrency trader and analyst Ali Martinez believes Ethereum (ETH) could have a massive breakout due to one keyEUROPE SAYS (EUROPESAYS.COM)

Crypto Trader Says One Factor Could Trigger Massive Breakout for Ethereum – Here’s His Outlook - EUROPE SAYS

Cryptocurrency trader and analyst Ali Martinez believes Ethereum (ETH) could have a massive breakout due to one keyEUROPE SAYS (EUROPESAYS.COM)

https://www.ft.com/content/8533f856-57f1-4765-a3dc-d866543092be

#FT #FinancialTimes #Alphaville #crypto #cryptocurrency #bitcoin #BTC #FTAV

Yahoo Finance

Daniel Howley

October 23, 2024

"#ArtificialIntelligence has driven shares of tech companies like #Microsoft (#MSFT), #Amazon (#AMZN), #Nvidia (N#VDA), and #Google (GOOG, GOOGL) to new highs this year. But the technology, which companies promise will revolutionize our lives, is driving something else just as high as stock prices: #EnergyConsumption [and #WaterConsumption].

"#AI #DataCenters use huge amounts of power and could increase energy demand by as much as 20% over the next decade, according to a Department of Energy spokesperson. Pair that with the continued growth of the broader cloud computing market, and you’ve got an energy squeeze.

"But Big Tech has also set ambitious sustainability goals focused on the use of low-carbon and zero-carbon sources to reduce its impact on climate change. While renewable energy like solar and wind are certainly part of that equation, tech companies need uninterruptible power sources. And for that, they’re leaning into #NuclearPower.

"Tech giants aren’t just planning to hook into existing plants, either. They’re working with energy companies to bring mothballed facilities like Pennsylvania’s Three Mile Island back online and looking to build small modular reactors (#SMRs) that take up less space than traditional plants and, the hope is, are cheaper to construct.

"But there are still plenty of questions as to whether these investments in nuclear energy will ever pan out, not to mention how long it will take to build any new reactors."

Read more:

https://www.aol.com/finance/big-tech-going-nuclear-power-201418756.html

#AI #NoNukesForAI #Cryptocurrency #WaterIsLife #NoNukes #RethinkNotRestart #ThreeMileIsland #TheTerminator #JudgmentDay #NuclearPowerNoThanks

Japan’s Self-Help Buzzword Industry Is Not a Real Fount of Wisdom

This is Bloomberg Opinion Today, a cross-cultural concordance of Bloomberg Opinion’s opinions. Sign up here .I just spent two weeks in Japan. But if you think I’ve brought back exotic pearls of wisdom, you’ll be disappointed.BYTESEU (Bytes Europe)

Who were the 2024 election's "crypto voters"? - EUROPE SAYS

In last month's election, one of the biggest winners was not on the ballot — it was inEUROPE SAYS (EUROPESAYS.COM)

#crypto #cryptocurrency #USpol #USpolitics

#crypto #cryptocurrency #TornadoCash

#crypto #cryptocurrency

#crypto #cryptocurrency

#crypto #cryptocurrency

https://www.citationneeded.news/issue-71/

#crypto #cryptocurrency

South Korea Crypto Market Collapses Following President Yoon’s Martial Law Announcement

South Korea’s crypto market plummeted after martial law was declared, with Bitcoin dropping 30% on Upbit. Crypto whales capitalized on market panic, transferring $163M USDT to seize discounted assets.BYTESEU (Bytes Europe)

#Celsius #crypto #cryptocurrency

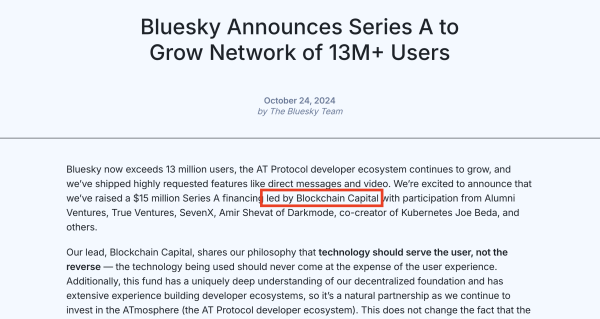

You don't have to take my word for it. Here's the official press release: https://bsky.social/about/blog/10-24-2024-series-a

Moving to BlueSky is not an escape. Growing a base there is just putting in a bunch of work to create a platform that will be co-opted by crypto bros as soon as X breaks in half.

p.s. crypto bros (#a16z) also own #Substack

#crypto #cryptocurrency #bitcoin #USDT #Trump #DonaldTrump

О криптовалюте

О криптовалюте На сайте «Свободной прессы» вышла статья В. Катасонова о криптовалюте — http://sss.agybvxkyyg.cgxa.fr2.gsr.awhoer.diaspora social network

![Justin Sun

Pro tip: If you’re one of the shadiest players in the cryptocurrency industry and want to avoid mainstream press attention on your $30 million bribe to the US president-elect via his cryptocurrency grift, just spend another $6 million on a concept art piece involving a real banana, and eat it.d That stunt will land you no fewer than five New York Times articles (plus a letter to the editor) in the span of eight days, with not a single mention of the Trump contribution.

I will give his backstory as briefly as I can, but I’m afraid it won’t be very brief. In 2017, Chinese citizen and then-resident Justin Sun launched an ICO for his Tron project, raising $70 million days after China banned ICOs, and then fled the country. He bought BitTorrent and tried to turn it into a cryptocurrency company by merging it with Tron, shocking BitTorrent executives who realized that Sun’s “market making” operations were just blatant insider trading. He did another ICO, this time shopping for a lawyer who would agree to write a letter he hoped would shield him from liability if he was later sued by the US SEC (and he was [W3IGG]). He bought the Poloniex cryptocurrency exchange from Circle, after their attempt to turn it from “shitcoin casino numero uno” (as per a former employee) into a legitimate operation failed upon the realization that the lax standards were the whole selling point. Sun promised to return it to its original anything-goes glory, at one point screaming at an employee Justin Sun

Pro tip: If you’re one of the shadiest players in the cryptocurrency industry and want to avoid mainstream press attention on your $30 million bribe to the US president-elect via his cryptocurrency grift, just spend another $6 million on a concept art piece involving a real banana, and eat it.d That stunt will land you no fewer than five New York Times articles (plus a letter to the editor) in the span of eight days, with not a single mention of the Trump contribution.

I will give his backstory as briefly as I can, but I’m afraid it won’t be very brief. In 2017, Chinese citizen and then-resident Justin Sun launched an ICO for his Tron project, raising $70 million days after China banned ICOs, and then fled the country. He bought BitTorrent and tried to turn it into a cryptocurrency company by merging it with Tron, shocking BitTorrent executives who realized that Sun’s “market making” operations were just blatant insider trading. He did another ICO, this time shopping for a lawyer who would agree to write a letter he hoped would shield him from liability if he was later sued by the US SEC (and he was [W3IGG]). He bought the Poloniex cryptocurrency exchange from Circle, after their attempt to turn it from “shitcoin casino numero uno” (as per a former employee) into a legitimate operation failed upon the realization that the lax standards were the whole selling point. Sun promised to return it to its original anything-goes glory, at one point screaming at an employee](https://friendica-leipzig.de/photo/preview/1024/332906)

![Justin Sun has since amassed an even larger collection of companies, many of which he pretends he doesn’t own or control. These include the Huobi exchange (which he rebranded to HTX), BitGlobal, and the TrueUSD stablecoin project. In September 2023, Huobi/HTX was hacked for $8 million [W3IGG]. In October 2023, TrueUSD either lied about having no affiliation with a token called $TEURO, or the TrueUSD deployer was compromised [W3IGG]. In November 2023, Poloniex was hacked for over $120 million [W3IGG]. Less than two weeks later, Huobi/HTX and its Heco Chain project were hacked for $115 million [W3IGG]. In May 2024, Crypto Critics Corner put out an episode presenting a rather convincing argument that Justin Sun is insolvent. They also outlined the incredible shadiness around his companies’ “proofs of reserves”, including the fact that multiple of his companies seem to be counting the same pool of assets as reserves.23

The crypto community distrusts Sun so much that an August announcement that BitGlobal (and thus Sun) would be helping to manage custody for wrapped bitcoin (WBTC) caused a mass exodus from the token. MakerDAO enthusiastically voted to stop accepting WBTC as collateral (before changing their minds after assurance that Sun didn’t have as much influence over WBTC management as they initially thought). Coinbase announced their own wrapped bitcoin product to use instead, and delisted WBTC. Kraken also announced a wrapped bitcoin product. Justin Sun has since amassed an even larger collection of companies, many of which he pretends he doesn’t own or control. These include the Huobi exchange (which he rebranded to HTX), BitGlobal, and the TrueUSD stablecoin project. In September 2023, Huobi/HTX was hacked for $8 million [W3IGG]. In October 2023, TrueUSD either lied about having no affiliation with a token called $TEURO, or the TrueUSD deployer was compromised [W3IGG]. In November 2023, Poloniex was hacked for over $120 million [W3IGG]. Less than two weeks later, Huobi/HTX and its Heco Chain project were hacked for $115 million [W3IGG]. In May 2024, Crypto Critics Corner put out an episode presenting a rather convincing argument that Justin Sun is insolvent. They also outlined the incredible shadiness around his companies’ “proofs of reserves”, including the fact that multiple of his companies seem to be counting the same pool of assets as reserves.23

The crypto community distrusts Sun so much that an August announcement that BitGlobal (and thus Sun) would be helping to manage custody for wrapped bitcoin (WBTC) caused a mass exodus from the token. MakerDAO enthusiastically voted to stop accepting WBTC as collateral (before changing their minds after assurance that Sun didn’t have as much influence over WBTC management as they initially thought). Coinbase announced their own wrapped bitcoin product to use instead, and delisted WBTC. Kraken also announced a wrapped bitcoin product.](https://friendica-leipzig.de/photo/preview/600/332908)

![So all this to say: who better for Donald Trump’s World Liberty Financial to bring on as its newest “adviser”? All it took was Sun’s purchase of $30 million worth of WLFI tokens,e which appears to be about as blatant an attempt to get out of the SEC’s crosshairs as the election spending by Coinbase, Ripple, and others. I’ve mentioned WLFI’s disappointing sales in previous issues [I68, 69, 70], and indeed the project had only sold around $20 million worth of the WLFI tokens in total until Sun came along, so the $30 million purchase certainly caught Trump’s attention. World Liberty Financial announced his advisory position in a tweet that described Sun, as is his preference, as merely “an advisor to HTX” and “a supporter of BitTorrent”. It played up his attendance of the University of Pennsylvania, which would've seemed like a bizarre thing to mention if it wasn’t so clear that it was an attempt by WLFI to downplay that Sun is a Chinese national.24

Now, Sun is telling reporters: “In terms of the friendly level [for] the crypto business, I think we could even say the best [jurisdiction] is the U.S.“25 He’s certainly hoping to make it so, especially for his incredibly sketchy brand of “crypto business”. So all this to say: who better for Donald Trump’s World Liberty Financial to bring on as its newest “adviser”? All it took was Sun’s purchase of $30 million worth of WLFI tokens,e which appears to be about as blatant an attempt to get out of the SEC’s crosshairs as the election spending by Coinbase, Ripple, and others. I’ve mentioned WLFI’s disappointing sales in previous issues [I68, 69, 70], and indeed the project had only sold around $20 million worth of the WLFI tokens in total until Sun came along, so the $30 million purchase certainly caught Trump’s attention. World Liberty Financial announced his advisory position in a tweet that described Sun, as is his preference, as merely “an advisor to HTX” and “a supporter of BitTorrent”. It played up his attendance of the University of Pennsylvania, which would've seemed like a bizarre thing to mention if it wasn’t so clear that it was an attempt by WLFI to downplay that Sun is a Chinese national.24

Now, Sun is telling reporters: “In terms of the friendly level [for] the crypto business, I think we could even say the best [jurisdiction] is the U.S.“25 He’s certainly hoping to make it so, especially for his incredibly sketchy brand of “crypto business”.](https://friendica-leipzig.de/photo/preview/600/332910)

![The trial was set for late January, and I was curious about how Mashinsky would approach it. Mashinsky is sort of your classic conman, relying on his charisma and ability to talk in circles to pass off his often highly exaggerated pronouncements, if not blatant lies — like claiming to have invented decentralized finance, VoIP, and Uber.3 The combination of mendacity and narcissism reminds me of Sam Bankman-Fried, who remained convinced of his ability to talk his way out of his fraud charges until — and perhaps after — his conviction and sentencing. Their similarities made me wonder if Mashinsky might also take the stand in his own defense.

Mashinsky seems to have proven more willing than Bankman-Fried to listen to the advice of his lawyers, and agreed to this plea deal soon after failing to have two of the charges against him dismissed before trial [I70]. In exchange for a guilty plea to two of the seven charges, commodities fraud and securities fraud, he will forfeit $48 million and face a maximum sentence of 30 years in prison — though he’s likely to get less. The trial was set for late January, and I was curious about how Mashinsky would approach it. Mashinsky is sort of your classic conman, relying on his charisma and ability to talk in circles to pass off his often highly exaggerated pronouncements, if not blatant lies — like claiming to have invented decentralized finance, VoIP, and Uber.3 The combination of mendacity and narcissism reminds me of Sam Bankman-Fried, who remained convinced of his ability to talk his way out of his fraud charges until — and perhaps after — his conviction and sentencing. Their similarities made me wonder if Mashinsky might also take the stand in his own defense.

Mashinsky seems to have proven more willing than Bankman-Fried to listen to the advice of his lawyers, and agreed to this plea deal soon after failing to have two of the charges against him dismissed before trial [I70]. In exchange for a guilty plea to two of the seven charges, commodities fraud and securities fraud, he will forfeit $48 million and face a maximum sentence of 30 years in prison — though he’s likely to get less.](https://friendica-leipzig.de/photo/preview/600/332892)